Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Etex <strong>Annual</strong> <strong>Report</strong> <strong>2014</strong><br />

Financial report<br />

Consolidated financial statements<br />

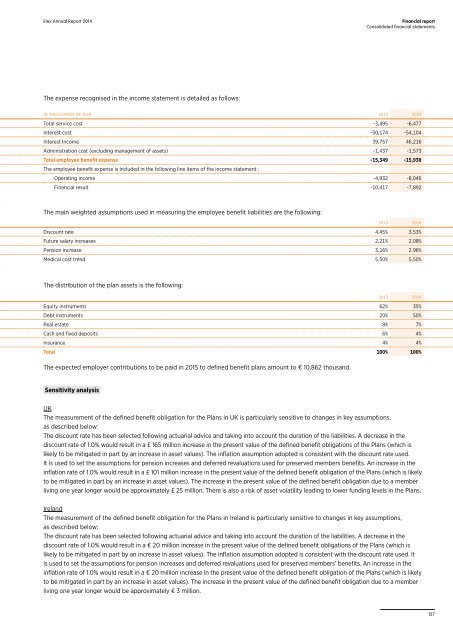

The expense recognised in the income statement is detailed as follows:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Total service cost -3,495 -6,477<br />

Interest cost -50,174 -54,104<br />

Interest Income 39,757 46,216<br />

Administration cost (excluding management of assets) -1,437 -1,573<br />

Total employee benefit expense -15,349 -15,938<br />

The employee benefit expense is included in the following line items of the income statement :<br />

Operating income -4,932 -8,046<br />

Financial result -10,417 -7,892<br />

The main weighted assumptions used in measuring the employee benefit liabilities are the following:<br />

2013 <strong>2014</strong><br />

Discount rate 4.45% 3.53%<br />

Future salary increases 2.21% 2.08%<br />

Pension increase 3.16% 2.96%<br />

Medical cost trend 5.50% 5.50%<br />

The distribution of the plan assets is the following:<br />

2013 <strong>2014</strong><br />

Equity instruments 62% 35%<br />

Debt instruments 20% 50%<br />

Real estate 8% 7%<br />

Cash and fixed deposits 6% 4%<br />

Insurance 4% 4%<br />

Total 100% 100%<br />

The expected employer contributions to be paid in 2015 to defined benefit plans amount to € 10,862 thousand.<br />

Sensitivity analysis<br />

UK<br />

The measurement of the defined benefit obligation for the Plans in UK is particularly sensitive to changes in key assumptions,<br />

as described below:<br />

The discount rate has been selected following actuarial advice and taking into account the duration of the liabilities. A decrease in the<br />

discount rate of 1.0% would result in a £ 165 million increase in the present value of the defined benefit obligations of the Plans (which is<br />

likely to be mitigated in part by an increase in asset values). The inflation assumption adopted is consistent with the discount rate used.<br />

It is used to set the assumptions for pension increases and deferred revaluations used for preserved members benefits. An increase in the<br />

inflation rate of 1.0% would result in a £ 101 million increase in the present value of the defined benefit obligation of the Plans (which is likely<br />

to be mitigated in part by an increase in asset values). The increase in the present value of the defined benefit obligation due to a member<br />

living one year longer would be approximately £ 25 million. There is also a risk of asset volatility leading to lower funding levels in the Plans.<br />

Ireland<br />

The measurement of the defined benefit obligation for the Plans in Ireland is particularly sensitive to changes in key assumptions,<br />

as described below:<br />

The discount rate has been selected following actuarial advice and taking into account the duration of the liabilities. A decrease in the<br />

discount rate of 1.0% would result in a € 20 million increase in the present value of the defined benefit obligations of the Plans (which is<br />

likely to be mitigated in part by an increase in asset values). The inflation assumption adopted is consistent with the discount rate used. It<br />

is used to set the assumptions for pension increases and deferred revaluations used for preserved members’ benefits. An increase in the<br />

inflation rate of 1.0% would result in a € 20 million increase in the present value of the defined benefit obligation of the Plans (which is likely<br />

to be mitigated in part by an increase in asset values). The increase in the present value of the defined benefit obligation due to a member<br />

living one year longer would be approximately € 3 million.<br />

127