Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial report<br />

Consolidated financial statements<br />

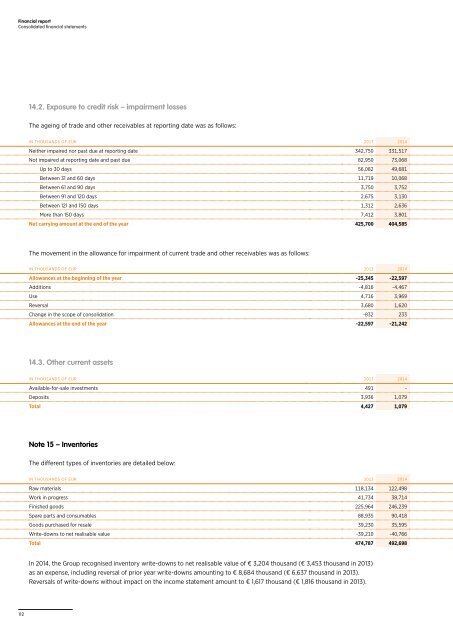

14.2. Exposure to credit risk – impairment losses<br />

The ageing of trade and other receivables at reporting date was as follows:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Neither impaired nor past due at reporting date 342,750 331,517<br />

Not impaired at reporting date and past due 82,950 73,068<br />

Up to 30 days 56,082 49,681<br />

Between 31 and 60 days 11,719 10,068<br />

Between 61 and 90 days 3,750 3,752<br />

Between 91 and 120 days 2,675 3,130<br />

Between 121 and 150 days 1,312 2,636<br />

More than 150 days 7,412 3,801<br />

Net carrying amount at the end of the year 425,700 404,585<br />

The movement in the allowance for impairment of current trade and other receivables was as follows:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Allowances at the beginning of the year -25,345 -22,597<br />

Additions -4,816 -4,467<br />

Use 4,716 3,969<br />

Reversal 3,680 1,620<br />

Change in the scope of consolidation -832 233<br />

Allowances at the end of the year -22,597 -21,242<br />

14.3. Other current assets<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Available-for-sale investments 491 -<br />

Deposits 3,936 1,079<br />

Total 4,427 1,079<br />

Note 15 – Inventories<br />

The different types of inventories are detailed below:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Raw materials 118,134 122,498<br />

Work in progress 41,734 38,714<br />

Finished goods 225,964 246,239<br />

Spare parts and consumables 88,935 90,418<br />

Goods purchased for resale 39,230 35,595<br />

Write-downs to net realisable value -39,210 -40,766<br />

Total 474,787 492,698<br />

In <strong>2014</strong>, the Group recognised inventory write-downs to net realisable value of € 3,204 thousand (€ 3,453 thousand in 2013)<br />

as an expense, including reversal of prior year write-downs amounting to € 8,684 thousand (€ 6,637 thousand in 2013).<br />

Reversals of write-downs without impact on the income statement amount to € 1,617 thousand (€ 1,816 thousand in 2013).<br />

112