Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Etex <strong>Annual</strong> <strong>Report</strong> <strong>2014</strong><br />

Financial report<br />

Consolidated financial statements<br />

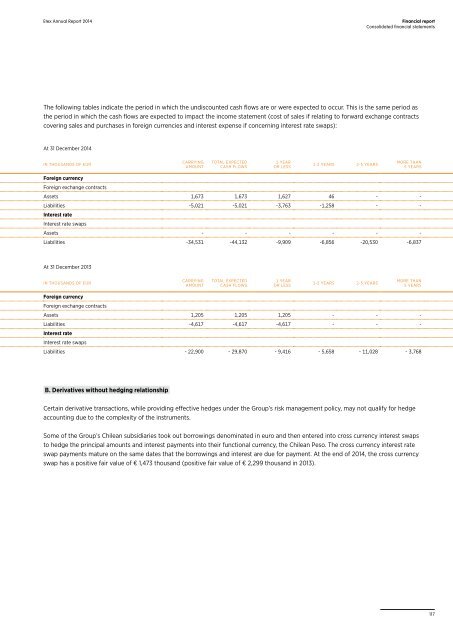

The following tables indicate the period in which the undiscounted cash flows are or were expected to occur. This is the same period as<br />

the period in which the cash flows are expected to impact the income statement (cost of sales if relating to forward exchange contracts<br />

covering sales and purchases in foreign currencies and interest expense if concerning interest rate swaps):<br />

At 31 December <strong>2014</strong><br />

IN THOUSANDS OF EUR<br />

CARRYING<br />

AMOUNT<br />

TOTAL EXPECTED<br />

CASH FLOWS<br />

1 YEAR<br />

OR LESS<br />

1-2 YEARS 2-5 YEARS<br />

MORE THAN<br />

5 YEARS<br />

Foreign currency<br />

Foreign exchange contracts<br />

Assets 1,673 1,673 1,627 46 - -<br />

Liabilities -5,021 -5,021 -3,763 -1,258 - -<br />

Interest rate<br />

Interest rate swaps<br />

Assets - - - - - -<br />

Liabilities -34,531 -44,132 -9,909 -6,856 -20,530 -6,837<br />

At 31 December 2013<br />

IN THOUSANDS OF EUR<br />

CARRYING<br />

AMOUNT<br />

TOTAL EXPECTED<br />

CASH FLOWS<br />

1 YEAR<br />

OR LESS<br />

1-2 YEARS 2-5 YEARS<br />

MORE THAN<br />

5 YEARS<br />

Foreign currency<br />

Foreign exchange contracts<br />

Assets 1,205 1,205 1,205 - - -<br />

Liabilities -4,617 -4,617 -4,617 - - -<br />

Interest rate<br />

Interest rate swaps<br />

Liabilities - 22,900 - 29,870 - 9,416 - 5,658 - 11,028 - 3,768<br />

B. Derivatives without hedging relationship<br />

Certain derivative transactions, while providing effective hedges under the Group’s risk management policy, may not qualify for hedge<br />

accounting due to the complexity of the instruments.<br />

Some of the Group’s Chilean subsidiaries took out borrowings denominated in euro and then entered into cross currency interest swaps<br />

to hedge the principal amounts and interest payments into their functional currency, the Chilean Peso. The cross currency interest rate<br />

swap payments mature on the same dates that the borrowings and interest are due for payment. At the end of <strong>2014</strong>, the cross currency<br />

swap has a positive fair value of € 1,473 thousand (positive fair value of € 2,299 thousand in 2013).<br />

117