Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial report<br />

Consolidated financial statements<br />

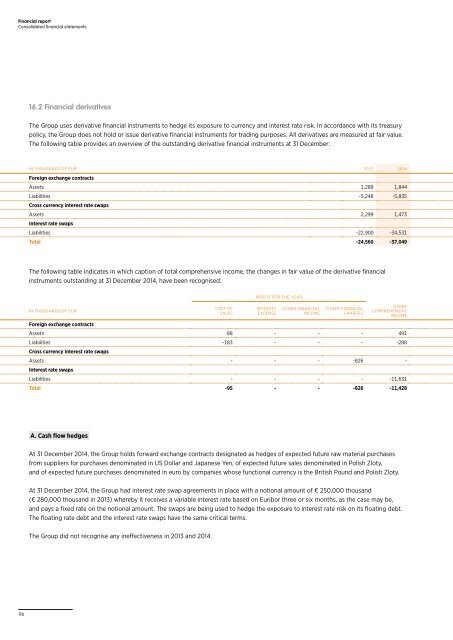

16.2 Financial derivatives<br />

The Group uses derivative financial instruments to hedge its exposure to currency and interest rate risk. In accordance with its treasury<br />

policy, the Group does not hold or issue derivative financial instruments for trading purposes. All derivatives are measured at fair value.<br />

The following table provides an overview of the outstanding derivative financial instruments at 31 December:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Foreign exchange contracts<br />

Assets 1,289 1,844<br />

Liabilities -5,248 -5,835<br />

Cross currency interest rate swaps<br />

Assets 2,299 1,473<br />

Interest rate swaps<br />

Liabilities -22,900 -34,531<br />

Total -24,560 -37,049<br />

The following table indicates in which caption of total comprehensive income, the changes in fair value of the derivative financial<br />

instruments outstanding at 31 December <strong>2014</strong>, have been recognised:<br />

IN THOUSANDS OF EUR<br />

COST OF<br />

SALES<br />

PROFIT FOR THE YEAR<br />

INTEREST<br />

EXPENSE<br />

OTHER FINANCIAL<br />

INCOME<br />

OTHER FINANCIAL<br />

CHARGES<br />

OTHER<br />

COMPREHENSIVE<br />

INCOME<br />

Foreign exchange contracts<br />

Assets 88 - - - 491<br />

Liabilities -183 - - - -288<br />

Cross currency interest rate swaps<br />

Assets - - - -826 -<br />

Interest rate swaps<br />

Liabilities - - - - -11,631<br />

Total -95 - - -826 -11,428<br />

A. Cash flow hedges<br />

At 31 December <strong>2014</strong>, the Group holds forward exchange contracts designated as hedges of expected future raw material purchases<br />

from suppliers for purchases denominated in US Dollar and Japanese Yen, of expected future sales denominated in Polish Zloty,<br />

and of expected future purchases denominated in euro by companies whose functional currency is the British Pound and Polish Zloty.<br />

At 31 December <strong>2014</strong>, the Group had interest rate swap agreements in place with a notional amount of € 250,000 thousand<br />

(€ 280,000 thousand in 2013) whereby it receives a variable interest rate based on Euribor three or six months, as the case may be,<br />

and pays a fixed rate on the notional amount. The swaps are being used to hedge the exposure to interest rate risk on its floating debt.<br />

The floating rate debt and the interest rate swaps have the same critical terms.<br />

The Group did not recognise any ineffectiveness in 2013 and <strong>2014</strong>.<br />

116