Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial report<br />

Consolidated financial statements<br />

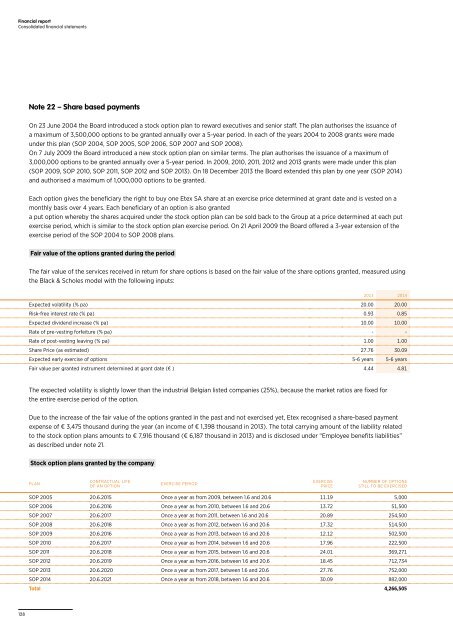

Note 22 – Share based payments<br />

On 23 June 2004 the Board introduced a stock option plan to reward executives and senior staff. The plan authorises the issuance of<br />

a maximum of 3,500,000 options to be granted annually over a 5-year period. In each of the years 2004 to 2008 grants were made<br />

under this plan (SOP 2004, SOP 2005, SOP 2006, SOP 2007 and SOP 2008).<br />

On 7 July 2009 the Board introduced a new stock option plan on similar terms. The plan authorises the issuance of a maximum of<br />

3,000,000 options to be granted annually over a 5-year period. In 2009, 2010, 2011, 2012 and 2013 grants were made under this plan<br />

(SOP 2009, SOP 2010, SOP 2011, SOP 2012 and SOP 2013). On 18 December 2013 the Board extended this plan by one year (SOP <strong>2014</strong>)<br />

and authorised a maximum of 1,000,000 options to be granted.<br />

Each option gives the beneficiary the right to buy one Etex SA share at an exercise price determined at grant date and is vested on a<br />

monthly basis over 4 years. Each beneficiary of an option is also granted<br />

a put option whereby the shares acquired under the stock option plan can be sold back to the Group at a price determined at each put<br />

exercise period, which is similar to the stock option plan exercise period. On 21 April 2009 the Board offered a 3-year extension of the<br />

exercise period of the SOP 2004 to SOP 2008 plans.<br />

Fair value of the options granted during the period<br />

The fair value of the services received in return for share options is based on the fair value of the share options granted, measured using<br />

the Black & Scholes model with the following inputs:<br />

2013 <strong>2014</strong><br />

Expected volatility (% pa) 20.00 20.00<br />

Risk-free interest rate (% pa) 0.93 0.85<br />

Expected dividend increase (% pa) 10.00 10.00<br />

Rate of pre-vesting forfeiture (% pa) - -<br />

Rate of post-vesting leaving (% pa) 1.00 1.00<br />

Share Price (as estimated) 27.76 30.09<br />

Expected early exercise of options 5-6 years 5-6 years<br />

Fair value per granted instrument determined at grant date (€ ) 4.44 4.81<br />

The expected volatility is slightly lower than the industrial Belgian listed companies (25%), because the market ratios are fixed for<br />

the entire exercise period of the option.<br />

Due to the increase of the fair value of the options granted in the past and not exercised yet, Etex recognised a share-based payment<br />

expense of € 3,475 thousand during the year (an income of € 1,398 thousand in 2013). The total carrying amount of the liability related<br />

to the stock option plans amounts to € 7,916 thousand (€ 6,187 thousand in 2013) and is disclosed under “Employee benefits liabilities”<br />

as described under note 21.<br />

Stock option plans granted by the company<br />

PLAN<br />

CONTRACTUAL LIFE<br />

OF AN OPTION<br />

EXERCISE PERIOD<br />

EXERCISE<br />

PRICE<br />

NUMBER OF OPTIONS<br />

STILL TO BE EXERCISED<br />

SOP 2005 20.6.2015 Once a year as from 2009, between 1.6 and 20.6 11.19 5,000<br />

SOP 2006 20.6.2016 Once a year as from 2010, between 1.6 and 20.6 13.72 51,500<br />

SOP 2007 20.6.2017 Once a year as from 2011, between 1.6 and 20.6 20.89 254,500<br />

SOP 2008 20.6.2018 Once a year as from 2012, between 1.6 and 20.6 17.32 514,500<br />

SOP 2009 20.6.2016 Once a year as from 2013, between 1.6 and 20.6 12.12 502,500<br />

SOP 2010 20.6.2017 Once a year as from <strong>2014</strong>, between 1.6 and 20.6 17.96 222,500<br />

SOP 2011 20.6.2018 Once a year as from 2015, between 1.6 and 20.6 24.01 369,271<br />

SOP 2012 20.6.2019 Once a year as from 2016, between 1.6 and 20.6 18.45 712,734<br />

SOP 2013 20.6.2020 Once a year as from 2017, between 1.6 and 20.6 27.76 752,000<br />

SOP <strong>2014</strong> 20.6.2021 Once a year as from 2018, between 1.6 and 20.6 30.09 882,000<br />

Total 4,266,505<br />

128