Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

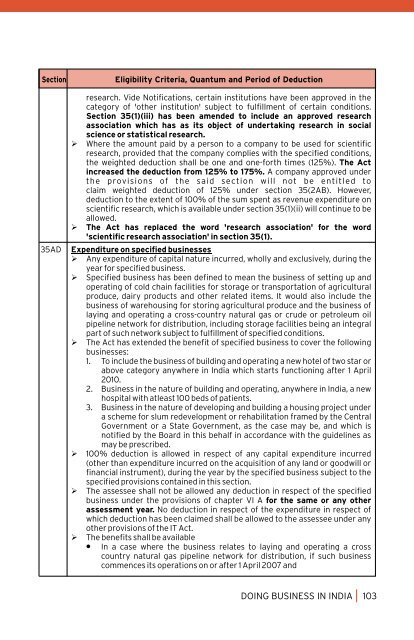

Section<br />

35AD<br />

Eligibility Criteria, Quantum and Period of Deduction<br />

research. Vide Notifications, certa<strong>in</strong> <strong>in</strong>stitutions have been approved <strong>in</strong> the<br />

category of 'other <strong>in</strong>stitution' subject to fulfillment of certa<strong>in</strong> conditions.<br />

Section 35(1)(iii) has been amended to <strong>in</strong>clude an approved research<br />

association which has as its object of undertak<strong>in</strong>g research <strong>in</strong> social<br />

science or statistical research.<br />

Where the amount paid by a person to a company to be used for scientific<br />

research, provided that the company complies with the specified conditions,<br />

the weighted deduction shall be one and one-forth times (125%). The Act<br />

<strong>in</strong>creased the deduction from 125% to 175%. A company approved under<br />

the provisions of the said section will not be entitled to<br />

claim weighted deduction of 125% under section 35(2AB). However,<br />

deduction to the extent of 100% of the sum spent as revenue expenditure on<br />

scientific research, which is available under section 35(1)(ii) will cont<strong>in</strong>ue to be<br />

allowed.<br />

The Act has replaced the word 'research association' for the word<br />

'scientific research association' <strong>in</strong> section 35(1).<br />

Expenditure on specified bus<strong>in</strong>esses<br />

Any expenditure of capital nature <strong>in</strong>curred, wholly and exclusively, dur<strong>in</strong>g the<br />

year for specified bus<strong>in</strong>ess.<br />

Specified bus<strong>in</strong>ess has been def<strong>in</strong>ed to mean the bus<strong>in</strong>ess of sett<strong>in</strong>g up and<br />

operat<strong>in</strong>g of cold cha<strong>in</strong> facilities for storage or transportation of agricultural<br />

produce, dairy products and other related items. It would also <strong>in</strong>clude the<br />

bus<strong>in</strong>ess of warehous<strong>in</strong>g for stor<strong>in</strong>g agricultural produce and the bus<strong>in</strong>ess of<br />

lay<strong>in</strong>g and operat<strong>in</strong>g a cross-country natural gas or crude or petroleum oil<br />

pipel<strong>in</strong>e network for distribution, <strong>in</strong>clud<strong>in</strong>g storage facilities be<strong>in</strong>g an <strong>in</strong>tegral<br />

part of such network subject to fulfillment of specified conditions.<br />

The Act has extended the benefit of specified bus<strong>in</strong>ess to cover the follow<strong>in</strong>g<br />

bus<strong>in</strong>esses:<br />

1. To <strong>in</strong>clude the bus<strong>in</strong>ess of build<strong>in</strong>g and operat<strong>in</strong>g a new hotel of two star or<br />

above category anywhere <strong>in</strong> <strong>India</strong> which starts function<strong>in</strong>g after 1 April<br />

2010.<br />

2. <strong>Bus<strong>in</strong>ess</strong> <strong>in</strong> the nature of build<strong>in</strong>g and operat<strong>in</strong>g, anywhere <strong>in</strong> <strong>India</strong>, a new<br />

hospital with atleast 100 beds of patients.<br />

3. <strong>Bus<strong>in</strong>ess</strong> <strong>in</strong> the nature of develop<strong>in</strong>g and build<strong>in</strong>g a hous<strong>in</strong>g project under<br />

a scheme for slum redevelopment or rehabilitation framed by the Central<br />

Government or a State Government, as the case may be, and which is<br />

notified by the Board <strong>in</strong> this behalf <strong>in</strong> accordance with the guidel<strong>in</strong>es as<br />

may be prescribed.<br />

100% deduction is allowed <strong>in</strong> respect of any capital expenditure <strong>in</strong>curred<br />

(other than expenditure <strong>in</strong>curred on the acquisition of any land or goodwill or<br />

f<strong>in</strong>ancial <strong>in</strong>strument), dur<strong>in</strong>g the year by the specified bus<strong>in</strong>ess subject to the<br />

specified provisions conta<strong>in</strong>ed <strong>in</strong> this section.<br />

The assessee shall not be allowed any deduction <strong>in</strong> respect of the specified<br />

bus<strong>in</strong>ess under the provisions of chapter VI A for the same or any other<br />

assessment year. No deduction <strong>in</strong> respect of the expenditure <strong>in</strong> respect of<br />

which deduction has been claimed shall be allowed to the assessee under any<br />

other provisions of the IT Act.<br />

The benefits shall be available<br />

In a case where the bus<strong>in</strong>ess relates to lay<strong>in</strong>g and operat<strong>in</strong>g a cross<br />

country natural gas pipel<strong>in</strong>e network for distribution, if such bus<strong>in</strong>ess<br />

commences its operations on or after 1 April 2007 and<br />

DOING BUSINESS IN INDIA 103