Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

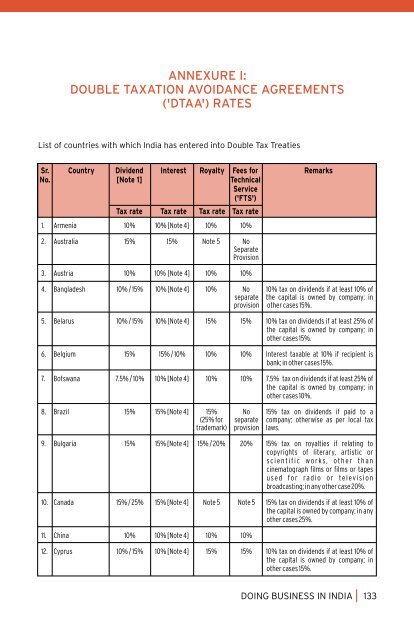

ANNEXURE I:<br />

DOUBLE TAXATION AVOIDANCE AGREEMENTS<br />

('DTAA') RATES<br />

List of countries with which <strong>India</strong> has entered <strong>in</strong>to Double Tax Treaties<br />

Sr.<br />

No.<br />

Country<br />

Dividend<br />

[Note 1]<br />

Tax rate<br />

Interest Royalty Fees for<br />

Technical<br />

Service<br />

('FTS')<br />

Tax rate Tax rate Tax rate<br />

1. Armenia 10% 10% [Note 4] 10% 10%<br />

Remarks<br />

2. Australia 15% 15% Note 5 No<br />

Separate<br />

Provision<br />

3. <strong>Austria</strong> 10% 10% [Note 4] 10% 10%<br />

4. Bangladesh 10% / 15% 10% [Note 4] 10% No 10% tax on dividends if at least 10% of<br />

separate the capital is owned by company; <strong>in</strong><br />

provision other cases 15%.<br />

5. Belarus 10% / 15% 10% [Note 4] 15% 15% 10% tax on dividends if at least 25% of<br />

the capital is owned by company; <strong>in</strong><br />

other cases 15%.<br />

6. Belgium 15% 15% / 10% 10% 10% Interest taxable at 10% if recipient is<br />

bank; <strong>in</strong> other cases 15%.<br />

7. Botswana 7.5% / 10% 10% [Note 4] 10% 10% 7.5% tax on dividends if at least 25% of<br />

the capital is owned by company; <strong>in</strong><br />

other cases 10%.<br />

8. Brazil 15% 15% [Note 4] 15% No 15% tax on dividends if paid to a<br />

(25% for separate company; otherwise as per local tax<br />

trademark) provision laws.<br />

9. Bulgaria 15% 15% [Note 4] 15% / 20% 20% 15% tax on royalties if relat<strong>in</strong>g to<br />

copyrights of literary, artistic or<br />

s c i e n t i f i c w o r k s, o t h e r t h a n<br />

c<strong>in</strong>ematograph films or films or tapes<br />

u sed fo r ra d i o o r te l ev i s i o n<br />

broadcast<strong>in</strong>g; <strong>in</strong> any other case 20%.<br />

10. Canada 15% / 25% 15% [Note 4] Note 5 Note 5 15% tax on dividends if at least 10% of<br />

the capital is owned by company; <strong>in</strong> any<br />

other cases 25%.<br />

11. Ch<strong>in</strong>a 10% 10% [Note 4] 10% 10%<br />

12. Cyprus 10% / 15% 10% [Note 4] 15% 15% 10% tax on dividends if at least 10% of<br />

the capital is owned by company; <strong>in</strong><br />

other cases 15%.<br />

DOING BUSINESS IN INDIA 133