Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

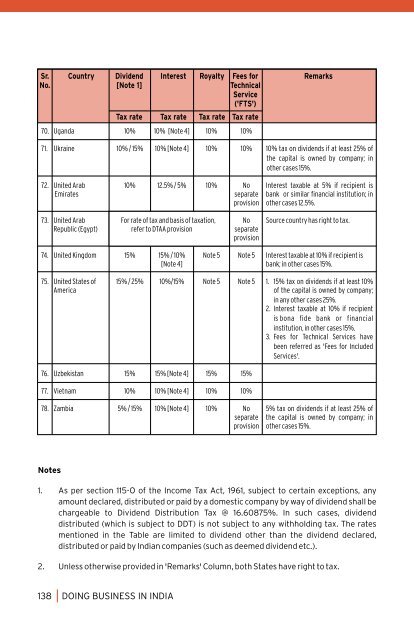

Sr.<br />

No.<br />

Country<br />

Dividend<br />

[Note 1]<br />

Tax rate<br />

Interest Royalty Fees for<br />

Technical<br />

Service<br />

('FTS')<br />

Tax rate Tax rate Tax rate<br />

70. Uganda 10% 10% [Note 4] 10% 10%<br />

Remarks<br />

71. Ukra<strong>in</strong>e 10% / 15% 10% [Note 4] 10% 10% 10% tax on dividends if at least 25% of<br />

the capital is owned by company; <strong>in</strong><br />

other cases 15%.<br />

72. United Arab 10% 12.5% / 5% 10% No Interest taxable at 5% if recipient is<br />

Emirates separate bank or similar f<strong>in</strong>ancial <strong>in</strong>stitution; <strong>in</strong><br />

provision other cases 12.5%.<br />

73. United Arab For rate of tax and basis of taxation, No Source country has right to tax.<br />

Republic (Egypt) refer to DTAA provision separate<br />

provision<br />

74. United K<strong>in</strong>gdom 15% 15% / 10% Note 5 Note 5 Interest taxable at 10% if recipient is<br />

[Note 4] bank; <strong>in</strong> other cases 15%.<br />

75. United States of 15% / 25% 10%/15% Note 5 Note 5 1. 15% tax on dividends if at least 10%<br />

America<br />

of the capital is owned by company;<br />

<strong>in</strong> any other cases 25%.<br />

2. Interest taxable at 10% if recipient<br />

is bona fide bank or f<strong>in</strong>ancial<br />

<strong>in</strong>stitution, <strong>in</strong> other cases 15%.<br />

3. Fees for Technical Services have<br />

been referred as 'Fees for Included<br />

Services'.<br />

76. Uzbekistan 15% 15% [Note 4] 15% 15%<br />

77. Vietnam 10% 10% [Note 4] 10% 10%<br />

78. Zambia 5% / 15% 10% [Note 4] 10% No 5% tax on dividends if at least 25% of<br />

separate the capital is owned by company; <strong>in</strong><br />

provision other cases 15%.<br />

Notes<br />

1. As per section 115-O of the Income Tax Act, 1961, subject to certa<strong>in</strong> exceptions, any<br />

amount declared, distributed or paid by a domestic company by way of dividend shall be<br />

chargeable to Dividend Distribution Tax @ 16.60875%. In such cases, dividend<br />

distributed (which is subject to DDT) is not subject to any withhold<strong>in</strong>g tax. The rates<br />

mentioned <strong>in</strong> the Table are limited to dividend other than the dividend declared,<br />

distributed or paid by <strong>India</strong>n companies (such as deemed dividend etc.).<br />

2. Unless otherwise provided <strong>in</strong> 'Remarks' Column, both States have right to tax.<br />

138<br />

DOING BUSINESS IN INDIA