Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

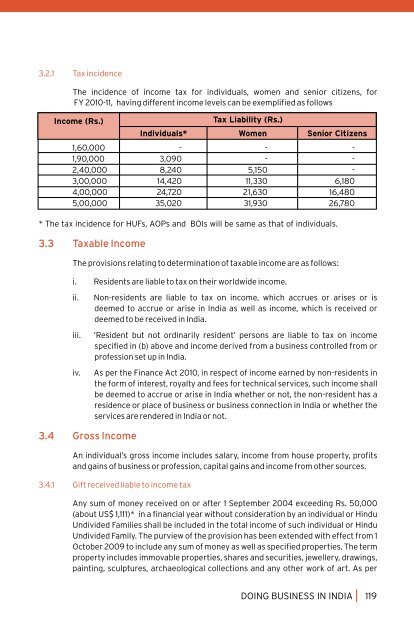

3.2.1 Tax <strong>in</strong>cidence<br />

The <strong>in</strong>cidence of <strong>in</strong>come tax for <strong>in</strong>dividuals, women and senior citizens, for<br />

FY 2010-11, hav<strong>in</strong>g different <strong>in</strong>come levels can be exemplified as follows<br />

Income (Rs.)<br />

Tax Liability (Rs.)<br />

Individuals* Women Senior Citizens<br />

1,60,000 - - -<br />

1,90,000 3,090 - -<br />

2,40,000 8,240 5,150 -<br />

3,00,000 14,420 11,330 6,180<br />

4,00,000 24,720 21,630 16,480<br />

5,00,000 35,020 31,930 26,780<br />

* The tax <strong>in</strong>cidence for HUFs, AOPs and BOIs will be same as that of <strong>in</strong>dividuals.<br />

3.3 Taxable Income<br />

The provisions relat<strong>in</strong>g to determ<strong>in</strong>ation of taxable <strong>in</strong>come are as follows:<br />

i. Residents are liable to tax on their worldwide <strong>in</strong>come.<br />

ii.<br />

iii.<br />

iv.<br />

Non-residents are liable to tax on <strong>in</strong>come, which accrues or arises or is<br />

deemed to accrue or arise <strong>in</strong> <strong>India</strong> as well as <strong>in</strong>come, which is received or<br />

deemed to be received <strong>in</strong> <strong>India</strong>.<br />

‘Resident but not ord<strong>in</strong>arily resident’ persons are liable to tax on <strong>in</strong>come<br />

specified <strong>in</strong> (b) above and <strong>in</strong>come derived from a bus<strong>in</strong>ess controlled from or<br />

profession set up <strong>in</strong> <strong>India</strong>.<br />

As per the F<strong>in</strong>ance Act 2010, <strong>in</strong> respect of <strong>in</strong>come earned by non-residents <strong>in</strong><br />

the form of <strong>in</strong>terest, royalty and fees for technical services, such <strong>in</strong>come shall<br />

be deemed to accrue or arise <strong>in</strong> <strong>India</strong> whether or not, the non-resident has a<br />

residence or place of bus<strong>in</strong>ess or bus<strong>in</strong>ess connection <strong>in</strong> <strong>India</strong> or whether the<br />

services are rendered <strong>in</strong> <strong>India</strong> or not.<br />

3.4 Gross Income<br />

An <strong>in</strong>dividual’s gross <strong>in</strong>come <strong>in</strong>cludes salary, <strong>in</strong>come from house property, profits<br />

and ga<strong>in</strong>s of bus<strong>in</strong>ess or profession, capital ga<strong>in</strong>s and <strong>in</strong>come from other sources.<br />

3.4.1 Gift received liable to <strong>in</strong>come tax<br />

Any sum of money received on or after 1 September 2004 exceed<strong>in</strong>g Rs. 50,000<br />

(about US$ 1,111)* <strong>in</strong> a f<strong>in</strong>ancial year without consideration by an <strong>in</strong>dividual or H<strong>in</strong>du<br />

Undivided Families shall be <strong>in</strong>cluded <strong>in</strong> the total <strong>in</strong>come of such <strong>in</strong>dividual or H<strong>in</strong>du<br />

Undivided Family. The purview of the provision has been extended with effect from 1<br />

October 2009 to <strong>in</strong>clude any sum of money as well as specified properties. The term<br />

property <strong>in</strong>cludes immovable properties, shares and securities, jewellery, draw<strong>in</strong>gs,<br />

pa<strong>in</strong>t<strong>in</strong>g, sculptures, archaeological collections and any other work of art. As per<br />

DOING BUSINESS IN INDIA 119