Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Doing Business in India - RSM Austria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

account and to liberalize the movement of foreign capital, a new law called the<br />

Foreign Exchange Management Act (FEMA) has come <strong>in</strong>to effect from 1 June 2000.<br />

2.0 ECONOMIC TRENDS<br />

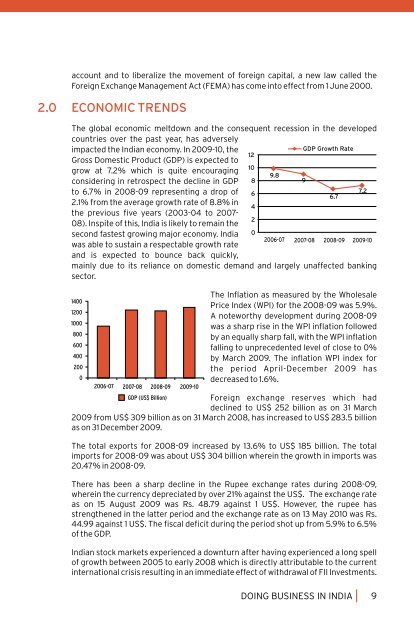

The global economic meltdown and the consequent recession <strong>in</strong> the developed<br />

countries over the past year, has adversely<br />

impacted the <strong>India</strong>n economy. In 2009-10, the<br />

GDP Growth Rate<br />

12<br />

Gross Domestic Product (GDP) is expected to<br />

10<br />

grow at 7.2% which is quite encourag<strong>in</strong>g<br />

9.8<br />

consider<strong>in</strong>g <strong>in</strong> retrospect the decl<strong>in</strong>e <strong>in</strong> GDP 8<br />

9<br />

to 6.7% <strong>in</strong> 2008-09 represent<strong>in</strong>g a drop of 6<br />

7.2<br />

6.7<br />

2.1% from the average growth rate of 8.8% <strong>in</strong><br />

4<br />

the previous five years (2003-04 to 2007-<br />

08). Inspite of this, <strong>India</strong> is likely to rema<strong>in</strong> the<br />

second fastest grow<strong>in</strong>g major economy. <strong>India</strong><br />

2<br />

0<br />

was able to susta<strong>in</strong> a respectable growth rate<br />

and is expected to bounce back quickly,<br />

2006-07 2007-08 2008-09 2009-10<br />

ma<strong>in</strong>ly due to its reliance on domestic demand and largely unaffected bank<strong>in</strong>g<br />

sector.<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

2006-07 2007-08 2008-09 2009-10<br />

The Inflation as measured by the Wholesale<br />

Price Index (WPI) for the 2008-09 was 5.9%.<br />

A noteworthy development dur<strong>in</strong>g 2008-09<br />

was a sharp rise <strong>in</strong> the WPI <strong>in</strong>flation followed<br />

by an equally sharp fall, with the WPI <strong>in</strong>flation<br />

fall<strong>in</strong>g to unprecedented level of close to 0%<br />

by March 2009. The <strong>in</strong>flation WPI <strong>in</strong>dex for<br />

the period April-December 2009 has<br />

decreased to 1.6%.<br />

GDP (US$ Billion)<br />

Foreign exchange reserves which had<br />

decl<strong>in</strong>ed to US$ 252 billion as on 31 March<br />

2009 from US$ 309 billion as on 31 March 2008, has <strong>in</strong>creased to US$ 283.5 billion<br />

as on 31 December 2009.<br />

The total exports for 2008-09 <strong>in</strong>creased by 13.6% to US$ 185 billion. The total<br />

imports for 2008-09 was about US$ 304 billion where<strong>in</strong> the growth <strong>in</strong> imports was<br />

20.47% <strong>in</strong> 2008-09.<br />

There has been a sharp decl<strong>in</strong>e <strong>in</strong> the Rupee exchange rates dur<strong>in</strong>g 2008-09,<br />

where<strong>in</strong> the currency depreciated by over 21% aga<strong>in</strong>st the US$. The exchange rate<br />

as on 15 August 2009 was Rs. 48.79 aga<strong>in</strong>st 1 US$. However, the rupee has<br />

strengthened <strong>in</strong> the latter period and the exchange rate as on 13 May 2010 was Rs.<br />

44.99 aga<strong>in</strong>st 1 US$. The fiscal deficit dur<strong>in</strong>g the period shot up from 5.9% to 6.5%<br />

of the GDP.<br />

<strong>India</strong>n stock markets experienced a downturn after hav<strong>in</strong>g experienced a long spell<br />

of growth between 2005 to early 2008 which is directly attributable to the current<br />

<strong>in</strong>ternational crisis result<strong>in</strong>g <strong>in</strong> an immediate effect of withdrawal of FII Investments.<br />

DOING BUSINESS IN INDIA 9