Single Audit Report Fiscal Year Ended June 30, 2012 - State ...

Single Audit Report Fiscal Year Ended June 30, 2012 - State ...

Single Audit Report Fiscal Year Ended June 30, 2012 - State ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

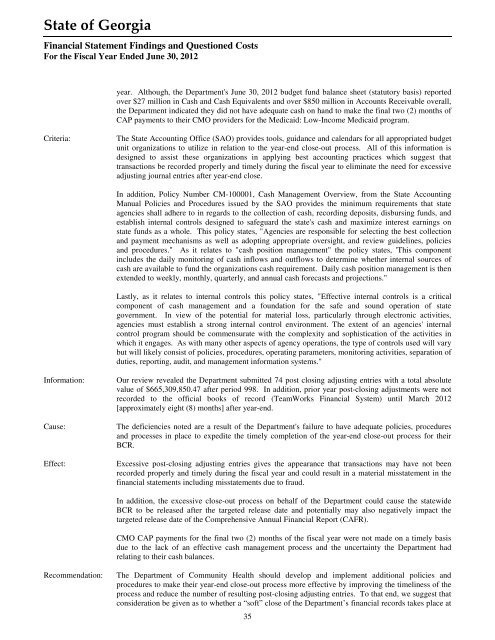

<strong>State</strong> of GeorgiaFinancial <strong>State</strong>ment Findings and Questioned CostsFor the <strong>Fiscal</strong> <strong>Year</strong> <strong>Ended</strong> <strong>June</strong> <strong>30</strong>, <strong>2012</strong>year. Although, the Department's <strong>June</strong> <strong>30</strong>, <strong>2012</strong> budget fund balance sheet (statutory basis) reportedover $27 million in Cash and Cash Equivalents and over $850 million in Accounts Receivable overall,the Department indicated they did not have adequate cash on hand to make the final two (2) months ofCAP payments to their CMO providers for the Medicaid: Low-Income Medicaid program.Criteria:The <strong>State</strong> Accounting Office (SAO) provides tools, guidance and calendars for all appropriated budgetunit organizations to utilize in relation to the year-end close-out process. All of this information isdesigned to assist these organizations in applying best accounting practices which suggest thattransactions be recorded properly and timely during the fiscal year to eliminate the need for excessiveadjusting journal entries after year-end close.In addition, Policy Number CM-100001, Cash Management Overview, from the <strong>State</strong> AccountingManual Policies and Procedures issued by the SAO provides the minimum requirements that stateagencies shall adhere to in regards to the collection of cash, recording deposits, disbursing funds, andestablish internal controls designed to safeguard the state's cash and maximize interest earnings onstate funds as a whole. This policy states, "Agencies are responsible for selecting the best collectionand payment mechanisms as well as adopting appropriate oversight, and review guidelines, policiesand procedures." As it relates to "cash position management" the policy states, 'This componentincludes the daily monitoring of cash inflows and outflows to determine whether internal sources ofcash are available to fund the organizations cash requirement. Daily cash position management is thenextended to weekly, monthly, quarterly, and annual cash forecasts and projections."Lastly, as it relates to internal controls this policy states, "Effective internal controls is a criticalcomponent of cash management and a foundation for the safe and sound operation of stategovernment. In view of the potential for material loss, particularly through electronic activities,agencies must establish a strong internal control environment. The extent of an agencies' internalcontrol program should be commensurate with the complexity and sophistication of the activities inwhich it engages. As with many other aspects of agency operations, the type of controls used will varybut will likely consist of policies, procedures, operating parameters, monitoring activities, separation ofduties, reporting, audit, and management information systems."Information:Cause:Effect:Our review revealed the Department submitted 74 post closing adjusting entries with a total absolutevalue of $665,<strong>30</strong>9,850.47 after period 998. In addition, prior year post-closing adjustments were notrecorded to the official books of record (TeamWorks Financial System) until March <strong>2012</strong>[approximately eight (8) months] after year-end.The deficiencies noted are a result of the Department's failure to have adequate policies, proceduresand processes in place to expedite the timely completion of the year-end close-out process for theirBCR.Excessive post-closing adjusting entries gives the appearance that transactions may have not beenrecorded properly and timely during the fiscal year and could result in a material misstatement in thefinancial statements including misstatements due to fraud.In addition, the excessive close-out process on behalf of the Department could cause the statewideBCR to be released after the targeted release date and potentially may also negatively impact thetargeted release date of the Comprehensive Annual Financial <strong>Report</strong> (CAFR).CMO CAP payments for the final two (2) months of the fiscal year were not made on a timely basisdue to the lack of an effective cash management process and the uncertainty the Department hadrelating to their cash balances.Recommendation:The Department of Community Health should develop and implement additional policies andprocedures to make their year-end close-out process more effective by improving the timeliness of theprocess and reduce the number of resulting post-closing adjusting entries. To that end, we suggest thatconsideration be given as to whether a “soft” close of the Department’s financial records takes place at35