Prudential Asia Prudential Asia

Prudential Asia Prudential Asia

Prudential Asia Prudential Asia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

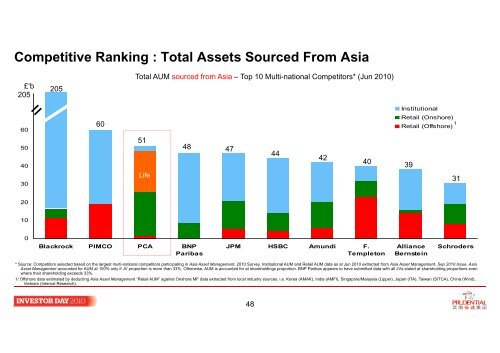

Competitive Ranking : Total Assets Sourced From <strong>Asia</strong>£‘b205 80205Total AUM sourced from <strong>Asia</strong> – Top10Multinational Multi-national Competitors* (Jun 2010)70605040306051Life4847444240InstitutionalRetail (Onshore)1Retail (Offshore)393120100Blackrock PIMCO PCA BNPParibasJPM HSBC Amundi F.TempletonAllianceBernsteinSchroders* Source: Competitors selected based on the largest multi-national competitors participating in <strong>Asia</strong> Asset Management, 2010 Survey. Institutional AUM and Retail AUM data as at Jun 2010 extracted from <strong>Asia</strong> Asset Management, Sep 2010 Issue. <strong>Asia</strong>Asset Management accounted for AUM at 100% only if JV proportion is more than 33%. Otherwise, AUM is accounted for at shareholdings proportion. BNP Paribas appears to have submitted data with all JVs stated at shareholding proportions evenwhere their shareholding exceeds 33%.1/ Offshore data estimated by deducting <strong>Asia</strong> Asset Management “Retail AUM” against Onshore MF data extracted from local industry sources. i.e. Korea (AMAK), India (AMFI), Singapore/Malaysia (Lipper), Japan (ITA), Taiwan (SITCA), China (Wind),Vietnam (Internal Research).48