Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

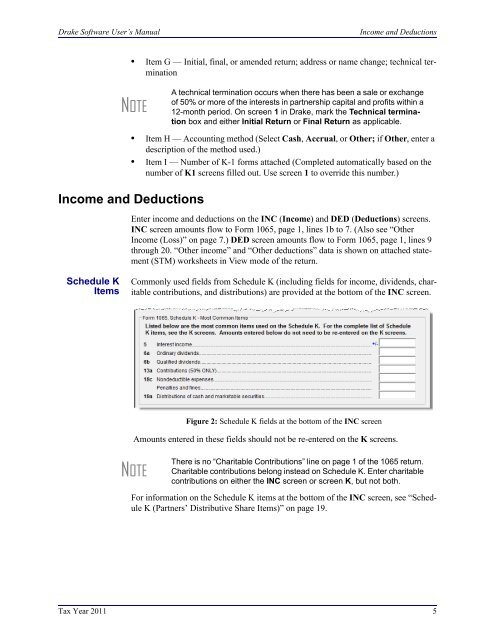

<strong>Drake</strong> <strong>Software</strong> User’s ManualIncome and Deductions• Item G — Initial, final, or amended return; address or name change; technical terminationNOTEA technical termination occurs when there has been a sale or exchangeof 50% or more of the interests in partnership capital and profits within a12-month period. On screen 1 in <strong>Drake</strong>, mark the Technical terminationbox and either Initial Return or Final Return as applicable.• Item H — Accounting method (Select Cash, Accrual, or Other; if Other, enter adescription of the method used.)• Item I — Number of K-1 <strong>for</strong>ms attached (Completed automatically based on thenumber of K1 screens filled out. Use screen 1 to override this number.)Income and DeductionsEnter income and deductions on the INC (Income) and DED (Deductions) screens.INC screen amounts flow to Form <strong>1065</strong>, page 1, lines 1b to 7. (Also see “OtherIncome (Loss)” on page 7.) DED screen amounts flow to Form <strong>1065</strong>, page 1, lines 9through 20. “Other income” and “Other deductions” data is shown on attached statement(STM) worksheets in View mode of the return.<strong>Schedule</strong> KItemsCommonly used fields from <strong>Schedule</strong> K (including fields <strong>for</strong> income, dividends, charitablecontributions, and distributions) are provided at the bottom of the INC screen.Figure 2: <strong>Schedule</strong> K fields at the bottom of the INC screenAmounts entered in these fields should not be re-entered on the K screens.NOTEThere is no “Charitable Contributions” line on page 1 of the <strong>1065</strong> return.Charitable contributions belong instead on <strong>Schedule</strong> K. Enter charitablecontributions on either the INC screen or screen K, but not both.For in<strong>for</strong>mation on the <strong>Schedule</strong> K items at the bottom of the INC screen, see “<strong>Schedule</strong>K (Partners’ Distributive Share Items)” on page 19.Tax Year 2011 5