Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

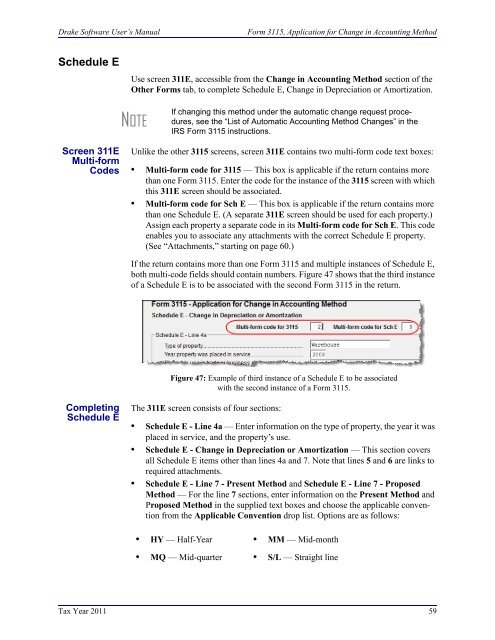

<strong>Drake</strong> <strong>Software</strong> User’s ManualForm 3115, Application <strong>for</strong> Change in Accounting Method<strong>Schedule</strong> EUse screen 311E, accessible from the Change in Accounting Method section of theOther Forms tab, to complete <strong>Schedule</strong> E, Change in Depreciation or Amortization.NOTEIf changing this method under the automatic change request procedures,see the “List of Automatic Accounting Method Changes” in theIRS Form 3115 instructions.Screen 311EMulti-<strong>for</strong>mCodesUnlike the other 3115 screens, screen 311E contains two multi-<strong>for</strong>m code text boxes:• Multi-<strong>for</strong>m code <strong>for</strong> 3115 — This box is applicable if the return contains morethan one Form 3115. Enter the code <strong>for</strong> the instance of the 3115 screen with whichthis 311E screen should be associated.• Multi-<strong>for</strong>m code <strong>for</strong> Sch E — This box is applicable if the return contains morethan one <strong>Schedule</strong> E. (A separate 311E screen should be used <strong>for</strong> each property.)Assign each property a separate code in its Multi-<strong>for</strong>m code <strong>for</strong> Sch E. This codeenables you to associate any attachments with the correct <strong>Schedule</strong> E property.(See “Attachments,” starting on page 60.)If the return contains more than one Form 3115 and multiple instances of <strong>Schedule</strong> E,both multi-code fields should contain numbers. Figure 47 shows that the third instanceof a <strong>Schedule</strong> E is to be associated with the second Form 3115 in the return.Figure 47: Example of third instance of a <strong>Schedule</strong> E to be associatedwith the second instance of a Form 3115.Completing<strong>Schedule</strong> EThe 311E screen consists of four sections:• <strong>Schedule</strong> E - Line 4a — Enter in<strong>for</strong>mation on the type of property, the year it wasplaced in service, and the property’s use.• <strong>Schedule</strong> E - Change in Depreciation or Amortization — This section coversall <strong>Schedule</strong> E items other than lines 4a and 7. Note that lines 5 and 6 are links torequired attachments.• <strong>Schedule</strong> E - Line 7 - Present Method and <strong>Schedule</strong> E - Line 7 - ProposedMethod — For the line 7 sections, enter in<strong>for</strong>mation on the Present Method andProposed Method in the supplied text boxes and choose the applicable conventionfrom the Applicable Convention drop list. Options are as follows:• HY — Half-Year • MM — Mid-month• MQ — Mid-quarter • S/L — Straight lineTax Year 2011 59