Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

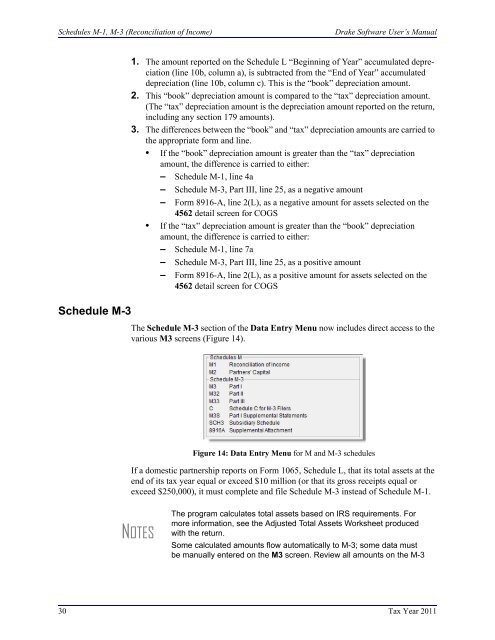

<strong>Schedule</strong>s M-1, M-3 (Reconciliation of Income)<strong>Drake</strong> <strong>Software</strong> User’s Manual<strong>Schedule</strong> M-31. The amount reported on the <strong>Schedule</strong> L “Beginning of Year” accumulated depreciation(line 10b, column a), is subtracted from the “End of Year” accumulateddepreciation (line 10b, column c). This is the “book” depreciation amount.2. This “book” depreciation amount is compared to the “tax” depreciation amount.(The “tax” depreciation amount is the depreciation amount reported on the return,including any section 179 amounts).3. The differences between the “book” and “tax” depreciation amounts are carried tothe appropriate <strong>for</strong>m and line.• If the “book” depreciation amount is greater than the “tax” depreciationamount, the difference is carried to either:– <strong>Schedule</strong> M-1, line 4a– <strong>Schedule</strong> M-3, Part III, line 25, as a negative amount– Form 8916-A, line 2(L), as a negative amount <strong>for</strong> assets selected on the4562 detail screen <strong>for</strong> COGS• If the “tax” depreciation amount is greater than the “book” depreciationamount, the difference is carried to either:– <strong>Schedule</strong> M-1, line 7a– <strong>Schedule</strong> M-3, Part III, line 25, as a positive amount– Form 8916-A, line 2(L), as a positive amount <strong>for</strong> assets selected on the4562 detail screen <strong>for</strong> COGSThe <strong>Schedule</strong> M-3 section of the Data Entry Menu now includes direct access to thevarious M3 screens (Figure 14).Figure 14: Data Entry Menu <strong>for</strong> M and M-3 schedulesIf a domestic partnership reports on Form <strong>1065</strong>, <strong>Schedule</strong> L, that its total assets at theend of its tax year equal or exceed $10 million (or that its gross receipts equal orexceed $250,000), it must complete and file <strong>Schedule</strong> M-3 instead of <strong>Schedule</strong> M-1.NOTESThe program calculates total assets based on IRS requirements. Formore in<strong>for</strong>mation, see the Adjusted Total Assets Worksheet producedwith the return.Some calculated amounts flow automatically to M-3; some data mustbe manually entered on the M3 screen. Review all amounts on the M-330 Tax Year 2011