Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

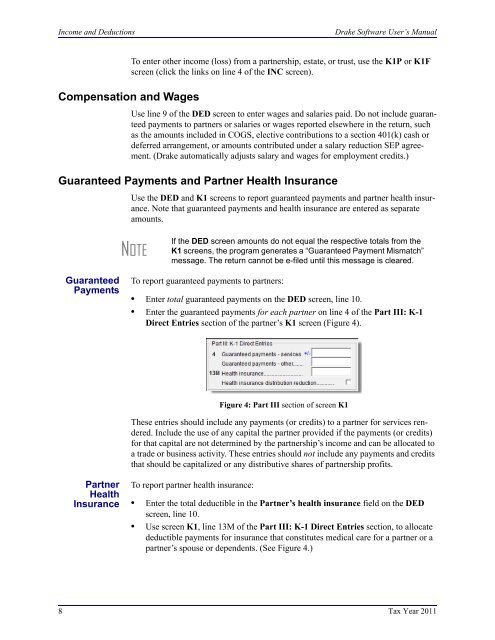

Income and Deductions<strong>Drake</strong> <strong>Software</strong> User’s ManualCompensation and WagesTo enter other income (loss) from a partnership, estate, or trust, use the K1P or K1Fscreen (click the links on line 4 of the INC screen).Use line 9 of the DED screen to enter wages and salaries paid. Do not include guaranteedpayments to partners or salaries or wages reported elsewhere in the return, suchas the amounts included in COGS, elective contributions to a section 401(k) cash ordeferred arrangement, or amounts contributed under a salary reduction SEP agreement.(<strong>Drake</strong> automatically adjusts salary and wages <strong>for</strong> employment credits.)Guaranteed Payments and Partner Health InsuranceUse the DED and K1 screens to report guaranteed payments and partner health insurance.Note that guaranteed payments and health insurance are entered as separateamounts.NOTEIf the DED screen amounts do not equal the respective totals from theK1 screens, the program generates a “Guaranteed Payment Mismatch”message. The return cannot be e-filed until this message is cleared.GuaranteedPaymentsTo report guaranteed payments to partners:• Enter total guaranteed payments on the DED screen, line 10.• Enter the guaranteed payments <strong>for</strong> each partner on line 4 of the Part III: K-1Direct Entries section of the partner’s K1 screen (Figure 4).Figure 4: Part III section of screen K1These entries should include any payments (or credits) to a partner <strong>for</strong> services rendered.Include the use of any capital the partner provided if the payments (or credits)<strong>for</strong> that capital are not determined by the partnership’s income and can be allocated toa trade or business activity. These entries should not include any payments and creditsthat should be capitalized or any distributive shares of partnership profits.PartnerHealthInsuranceTo report partner health insurance:• Enter the total deductible in the Partner’s health insurance field on the DEDscreen, line 10.• Use screen K1, line 13M of the Part III: K-1 Direct Entries section, to allocatedeductible payments <strong>for</strong> insurance that constitutes medical care <strong>for</strong> a partner or apartner’s spouse or dependents. (See Figure 4.)8 Tax Year 2011