Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

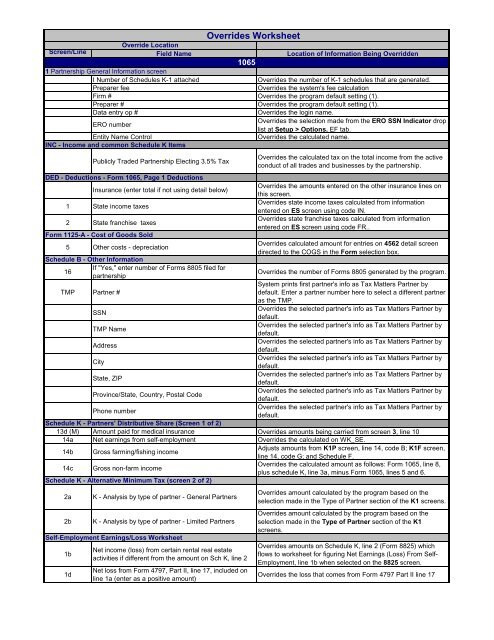

Override LocationScreen/Line Field Name Location of In<strong>for</strong>mation Being Overridden<strong>1065</strong>1 Partnership General In<strong>for</strong>mation screenI Number of <strong>Schedule</strong>s K-1 attachedOverrides the number of K-1 schedules that are generated.Preparer feeOverrides the system's fee calculationFirm # Overrides the program default setting (1).Preparer # Overrides the program default setting (1).Data entry op #Overrides the login name.ERO numberOverrides the selection made from the ERO SSN Indicator droplist at Setup > Options, EF tab.Entity Name ControlOverrides the calculated name.INC - Income and common <strong>Schedule</strong> K ItemsPublicly Traded Partnership Electing 3.5% TaxDED - Deductions - Form <strong>1065</strong>, Page 1 DeductionsInsurance (enter total if not using detail below)1 State income taxes2 State franchise taxesForm 1125-A - Cost of Goods Sold5 Other costs - depreciation<strong>Schedule</strong> B - Other In<strong>for</strong>mationIf "Yes," enter number of Forms 8805 filed <strong>for</strong>16partnershipOverrides the calculated tax on the total income from the activeconduct of all trades and businesses by the partnership.Overrides the amounts entered on the other insurance lines onthis screen.Overrides state income taxes calculated from in<strong>for</strong>mationentered on ES screen using code IN.Overrides state franchise taxes calculated from in<strong>for</strong>mationentered on ES screen using code FR..Overrides calculated amount <strong>for</strong> entries on 4562 detail screendirected to the COGS in the Form selection box.Overrides the number of Forms 8805 generated by the program.TMP Partner #System prints first partner's info as Tax Matters Partner bydefault. Enter a partner number here to select a different partneras the TMP.SSNOverrides the selected partner's info as Tax Matters Partner bydefault.TMP NameOverrides the selected partner's info as Tax Matters Partner bydefault.AddressOverrides the selected partner's info as Tax Matters Partner bydefault.CityOverrides the selected partner's info as Tax Matters Partner bydefault.State, ZIPOverrides the selected partner's info as Tax Matters Partner bydefault.Province/State, Country, Postal CodeOverrides the selected partner's info as Tax Matters Partner bydefault.Phone numberOverrides the selected partner's info as Tax Matters Partner bydefault.<strong>Schedule</strong> K - Partners' Distributive Share (Screen 1 of 2)13d (M) Amount paid <strong>for</strong> medical insurance Overrides amounts being carried from screen 3, line 1014a Net earnings from self-employment Overrides the calculated on WK_SE.14b Gross farming/fishing incomeAdjusts amounts from K1P screen, line 14, code B; K1F screen,line 14, code G; and <strong>Schedule</strong> F.14c Gross non-farm incomeOverrides the calculated amount as follows: Form <strong>1065</strong>, line 8,plus schedule K, line 3a, minus Form <strong>1065</strong>, lines 5 and 6.<strong>Schedule</strong> K - Alternative Minimum Tax (screen 2 of 2)2a2bK - Analysis by type of partner - General PartnersK - Analysis by type of partner - Limited PartnersSelf-Employment Earnings/Loss Worksheet1b1dNet income (loss) from certain rental real estateactivities if different from the amount on Sch K, line 2Net loss from Form 4797, Part II, line 17, included online 1a (enter as a positive amount)Overrides WorksheetOverrides amount calculated by the program based on theselection made in the Type of Partner section of the K1 screens.Overrides amount calculated by the program based on theselection made in the Type of Partner section of the K1screens.Overrides amounts on <strong>Schedule</strong> K, line 2 (Form 8825) whichflows to worksheet <strong>for</strong> figuring Net Earnings (Loss) From Self-Employment, line 1b when selected on the 8825 screen.Overrides the loss that comes from Form 4797 Part II line 17