Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

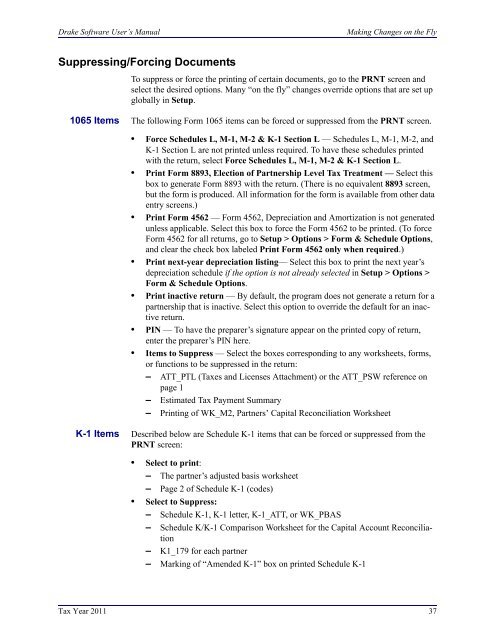

<strong>Drake</strong> <strong>Software</strong> User’s ManualMaking Changes on the FlySuppressing/Forcing DocumentsTo suppress or <strong>for</strong>ce the printing of certain documents, go to the PRNT screen andselect the desired options. Many “on the fly” changes override options that are set upglobally in Setup.<strong>1065</strong> Items The following Form <strong>1065</strong> items can be <strong>for</strong>ced or suppressed from the PRNT screen.• Force <strong>Schedule</strong>s L, M-1, M-2 & K-1 Section L — <strong>Schedule</strong>s L, M-1, M-2, andK-1 Section L are not printed unless required. To have these schedules printedwith the return, select Force <strong>Schedule</strong>s L, M-1, M-2 & K-1 Section L.• Print Form 8893, Election of Partnership Level Tax Treatment — Select thisbox to generate Form 8893 with the return. (There is no equivalent 8893 screen,but the <strong>for</strong>m is produced. All in<strong>for</strong>mation <strong>for</strong> the <strong>for</strong>m is available from other dataentry screens.)• Print Form 4562 — Form 4562, Depreciation and Amortization is not generatedunless applicable. Select this box to <strong>for</strong>ce the Form 4562 to be printed. (To <strong>for</strong>ceForm 4562 <strong>for</strong> all returns, go to Setup > Options > Form & <strong>Schedule</strong> Options,and clear the check box labeled Print Form 4562 only when required.)• Print next-year depreciation listing— Select this box to print the next year’sdepreciation schedule if the option is not already selected in Setup > Options >Form & <strong>Schedule</strong> Options.• Print inactive return — By default, the program does not generate a return <strong>for</strong> apartnership that is inactive. Select this option to override the default <strong>for</strong> an inactivereturn.• PIN — To have the preparer’s signature appear on the printed copy of return,enter the preparer’s PIN here.• Items to Suppress — Select the boxes corresponding to any worksheets, <strong>for</strong>ms,or functions to be suppressed in the return:– ATT_PTL (Taxes and Licenses Attachment) or the ATT_PSW reference onpage 1– Estimated Tax Payment Summary– Printing of WK_M2, Partners’ Capital Reconciliation WorksheetK-1 Items Described below are <strong>Schedule</strong> K-1 items that can be <strong>for</strong>ced or suppressed from thePRNT screen:• Select to print:– The partner’s adjusted basis worksheet– Page 2 of <strong>Schedule</strong> K-1 (codes)• Select to Suppress:– <strong>Schedule</strong> K-1, K-1 letter, K-1_ATT, or WK_PBAS– <strong>Schedule</strong> K/K-1 Comparison Worksheet <strong>for</strong> the Capital Account Reconciliation– K1_179 <strong>for</strong> each partner– Marking of “Amended K-1” box on printed <strong>Schedule</strong> K-1Tax Year 2011 37