Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

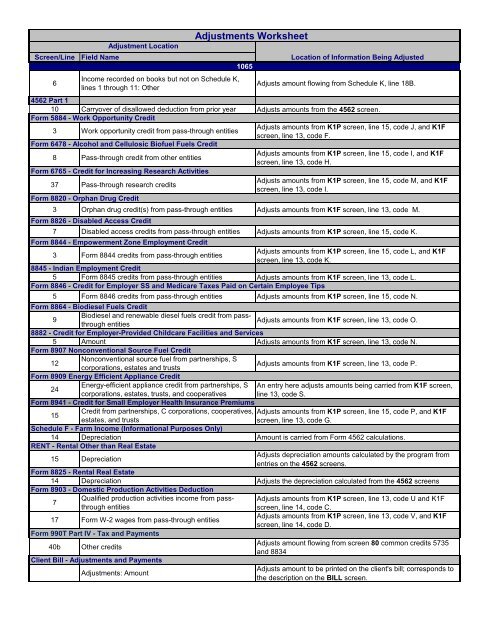

Adjustment LocationAdjustments WorksheetScreen/Line Field Name Location of In<strong>for</strong>mation Being Adjusted<strong>1065</strong>6Income recorded on books but not on <strong>Schedule</strong> K,lines 1 through 11: OtherAdjusts amount flowing from <strong>Schedule</strong> K, line 18B.4562 Part 110 Carryover of disallowed deduction from prior year Adjusts amounts from the 4562 screen.Form 5884 - Work Opportunity Credit3 Work opportunity credit from pass-through entitiesAdjusts amounts from K1P screen, line 15, code J, and K1Fscreen, line 13, code F.Form 6478 - Alcohol and Cellulosic Biofuel Fuels Credit8 Pass-through credit from other entitiesAdjusts amounts from K1P screen, line 15, code I, and K1Fscreen, line 13, code H.Form 6765 - Credit <strong>for</strong> Increasing Research Activities37 Pass-through research creditsAdjusts amounts from K1P screen, line 15, code M, and K1Fscreen, line 13, code I.Form 8820 - Orphan Drug Credit3 Orphan drug credit(s) from pass-through entities Adjusts amounts from K1F screen, line 13, code M.Form 8826 - Disabled Access Credit7 Disabled access credits from pass-through entities Adjusts amounts from K1P screen, line 15, code K.Form 8844 - Empowerment Zone Employment Credit3 Form 8844 credits from pass-through entitiesAdjusts amounts from K1P screen, line 15, code L, and K1Fscreen, line 13, code K.8845 - Indian Employment Credit5 Form 8845 credits from pass-through entities Adjusts amounts from K1F screen, line 13, code L.Form 8846 - Credit <strong>for</strong> Employer SS and Medicare Taxes Paid on Certain Employee Tips5 Form 8846 credits from pass-through entities Adjusts amounts from K1P screen, line 15, code N.Form 8864 - Biodiesel Fuels Credit9Biodiesel and renewable diesel fuels credit from passthroughentitiesAdjusts amounts from K1F screen, line 13, code O.8882 - Credit <strong>for</strong> Employer-Provided Childcare Facilities and Services5 Amount Adjusts amounts from K1F screen, line 13, code N.Form 8907 Nonconventional Source Fuel Credit12Nonconventional source fuel from partnerships, Scorporations, estates and trustsAdjusts amounts from K1F screen, line 13, code P.Form 8909 Energy Efficient Appliance Credit24Energy-efficient appliance credit from partnerships, S An entry here adjusts amounts being carried from K1F screen,corporations, estates, trusts, and cooperatives line 13, code S.Form 8941 - Credit <strong>for</strong> Small Employer Health Insurance Premiums15Credit from partnerships, C corporations, cooperatives, Adjusts amounts from K1P screen, line 15, code P, and K1Festates, and trustsscreen, line 13, code G.<strong>Schedule</strong> F - Farm Income (In<strong>for</strong>mational Purposes Only)14 Depreciation Amount is carried from Form 4562 calculations.RENT - Rental Other than Real Estate15 DepreciationAdjusts depreciation amounts calculated by the program fromentries on the 4562 screens.Form 8825 - Rental Real Estate14 Depreciation Adjusts the depreciation calculated from the 4562 screensForm 8903 - Domestic Production Activities Deduction7Qualified production activities income from passthroughentitiesscreen, line 14, code C.Adjusts amounts from K1P screen, line 13, code U and K1F17 Form W-2 wages from pass-through entitiesAdjusts amounts from K1P screen, line 13, code V, and K1Fscreen, line 14, code D.Form 990T Part IV - Tax and Payments40b Other creditsAdjusts amount flowing from screen 80 common credits 5735and 8834Client Bill - Adjustments and PaymentsAdjustments: AmountAdjusts amount to be printed on the client's bill; corresponds tothe description on the BILL screen.