Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

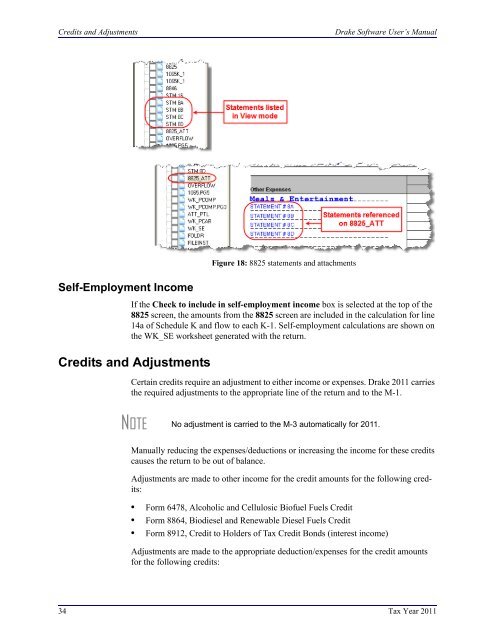

Credits and Adjustments<strong>Drake</strong> <strong>Software</strong> User’s ManualSelf-Employment IncomeFigure 18: 8825 statements and attachmentsIf the Check to include in self-employment income box is selected at the top of the8825 screen, the amounts from the 8825 screen are included in the calculation <strong>for</strong> line14a of <strong>Schedule</strong> K and flow to each K-1. Self-employment calculations are shown onthe WK_SE worksheet generated with the return.Credits and AdjustmentsCertain credits require an adjustment to either income or expenses. <strong>Drake</strong> 2011 carriesthe required adjustments to the appropriate line of the return and to the M-1.NOTE No adjustment is carried to the M-3 automatically <strong>for</strong> 2011.Manually reducing the expenses/deductions or increasing the income <strong>for</strong> these creditscauses the return to be out of balance.Adjustments are made to other income <strong>for</strong> the credit amounts <strong>for</strong> the following credits:• Form 6478, Alcoholic and Cellulosic Biofuel Fuels Credit• Form 8864, Biodiesel and Renewable Diesel Fuels Credit• Form 8912, Credit to Holders of Tax Credit Bonds (interest income)Adjustments are made to the appropriate deduction/expenses <strong>for</strong> the credit amounts<strong>for</strong> the following credits:34 Tax Year 2011