Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

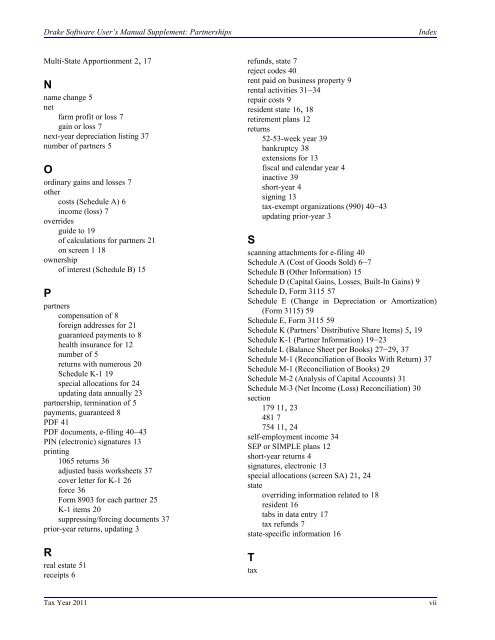

<strong>Drake</strong> <strong>Software</strong> User’s Manual Supplement: PartnershipsIndexMulti-State Apportionment 2, 17Nname change 5netfarm profit or loss 7gain or loss 7next-year depreciation listing 37number of partners 5Oordinary gains and losses 7othercosts (<strong>Schedule</strong> A) 6income (loss) 7overridesguide to 19of calculations <strong>for</strong> partners 21on screen 1 18ownershipof interest (<strong>Schedule</strong> B) 15Ppartnerscompensation of 8<strong>for</strong>eign addresses <strong>for</strong> 21guaranteed payments to 8health insurance <strong>for</strong> 12number of 5returns with numerous 20<strong>Schedule</strong> K-1 19special allocations <strong>for</strong> 24updating data annually 23partnership, termination of 5payments, guaranteed 8PDF 41PDF documents, e-filing 40–43PIN (electronic) signatures 13printing<strong>1065</strong> returns 36adjusted basis worksheets 37cover letter <strong>for</strong> K-1 26<strong>for</strong>ce 36Form 8903 <strong>for</strong> each partner 25K-1 items 20suppressing/<strong>for</strong>cing documents 37prior-year returns, updating 3Rreal estate 51receipts 6refunds, state 7reject codes 40rent paid on business property 9rental activities 31–34repair costs 9resident state 16, 18retirement plans 12returns52-53-week year 39bankruptcy 38extensions <strong>for</strong> 13fiscal and calendar year 4inactive 39short-year 4signing 13tax-exempt organizations (990) 40–43updating prior-year 3Sscanning attachments <strong>for</strong> e-filing 40<strong>Schedule</strong> A (Cost of Goods Sold) 6–7<strong>Schedule</strong> B (Other In<strong>for</strong>mation) 15<strong>Schedule</strong> D (Capital Gains, Losses, Built-In Gains) 9<strong>Schedule</strong> D, Form 3115 57<strong>Schedule</strong> E (Change in Depreciation or Amortization)(Form 3115) 59<strong>Schedule</strong> E, Form 3115 59<strong>Schedule</strong> K (Partners’ Distributive Share Items) 5, 19<strong>Schedule</strong> K-1 (Partner In<strong>for</strong>mation) 19–23<strong>Schedule</strong> L (Balance Sheet per Books) 27–29, 37<strong>Schedule</strong> M-1 (Reconciliation of Books With Return) 37<strong>Schedule</strong> M-1 (Reconciliation of Books) 29<strong>Schedule</strong> M-2 (Analysis of Capital Accounts) 31<strong>Schedule</strong> M-3 (Net Income (Loss) Reconciliation) 30section179 11, 23481 7754 11, 24self-employment income 34SEP or SIMPLE plans 12short-year returns 4signatures, electronic 13special allocations (screen SA) 21, 24stateoverriding in<strong>for</strong>mation related to 18resident 16tabs in data entry 17tax refunds 7state-specific in<strong>for</strong>mation 16TtaxTax Year 2011vii