Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

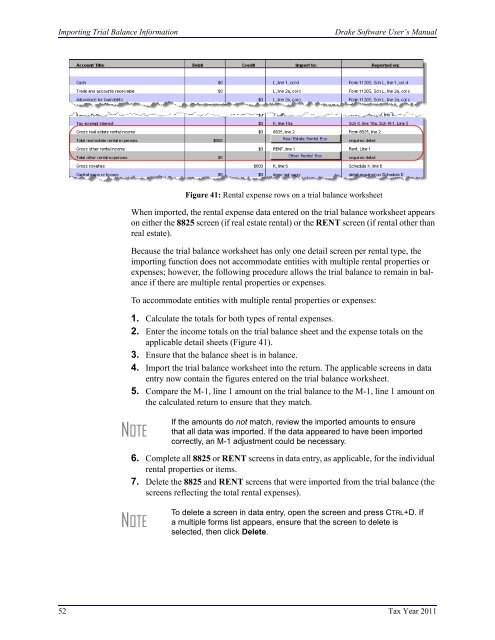

Importing Trial Balance In<strong>for</strong>mation<strong>Drake</strong> <strong>Software</strong> User’s ManualFigure 41: Rental expense rows on a trial balance worksheetWhen imported, the rental expense data entered on the trial balance worksheet appearson either the 8825 screen (if real estate rental) or the RENT screen (if rental other thanreal estate).Because the trial balance worksheet has only one detail screen per rental type, theimporting function does not accommodate entities with multiple rental properties orexpenses; however, the following procedure allows the trial balance to remain in balanceif there are multiple rental properties or expenses.To accommodate entities with multiple rental properties or expenses:1. Calculate the totals <strong>for</strong> both types of rental expenses.2. Enter the income totals on the trial balance sheet and the expense totals on theapplicable detail sheets (Figure 41).3. Ensure that the balance sheet is in balance.4. Import the trial balance worksheet into the return. The applicable screens in dataentry now contain the figures entered on the trial balance worksheet.5. Compare the M-1, line 1 amount on the trial balance to the M-1, line 1 amount onthe calculated return to ensure that they match.NOTEIf the amounts do not match, review the imported amounts to ensurethat all data was imported. If the data appeared to have been importedcorrectly, an M-1 adjustment could be necessary.6. Complete all 8825 or RENT screens in data entry, as applicable, <strong>for</strong> the individualrental properties or items.7. Delete the 8825 and RENT screens that were imported from the trial balance (thescreens reflecting the total rental expenses).NOTETo delete a screen in data entry, open the screen and press CTRL+D. Ifa multiple <strong>for</strong>ms list appears, ensure that the screen to delete isselected, then click Delete.52 Tax Year 2011