Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

Schedule K-1 for 1065 - Drake Software

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

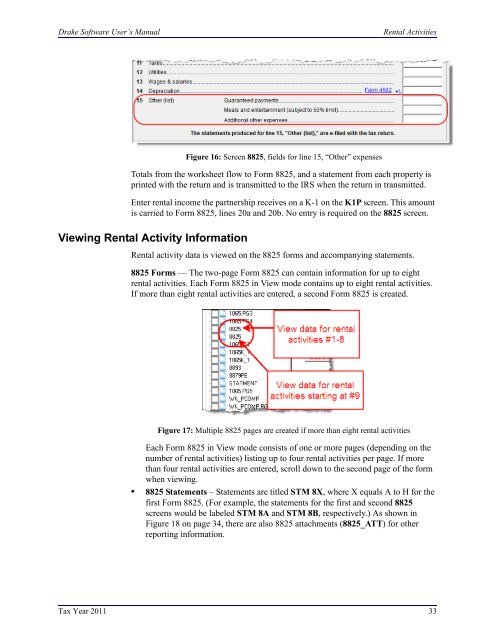

<strong>Drake</strong> <strong>Software</strong> User’s ManualRental ActivitiesFigure 16: Screen 8825, fields <strong>for</strong> line 15, “Other” expensesTotals from the worksheet flow to Form 8825, and a statement from each property isprinted with the return and is transmitted to the IRS when the return in transmitted.Enter rental income the partnership receives on a K-1 on the K1P screen. This amountis carried to Form 8825, lines 20a and 20b. No entry is required on the 8825 screen.Viewing Rental Activity In<strong>for</strong>mationRental activity data is viewed on the 8825 <strong>for</strong>ms and accompanying statements.8825 Forms — The two-page Form 8825 can contain in<strong>for</strong>mation <strong>for</strong> up to eightrental activities. Each Form 8825 in View mode contains up to eight rental activities.If more than eight rental activities are entered, a second Form 8825 is created.Figure 17: Multiple 8825 pages are created if more than eight rental activitiesEach Form 8825 in View mode consists of one or more pages (depending on thenumber of rental activities) listing up to four rental activities per page. If morethan four rental activities are entered, scroll down to the second page of the <strong>for</strong>mwhen viewing.• 8825 Statements – Statements are titled STM 8X, where X equals A to H <strong>for</strong> thefirst Form 8825. (For example, the statements <strong>for</strong> the first and second 8825screens would be labeled STM 8A and STM 8B, respectively.) As shown inFigure 18 on page 34, there are also 8825 attachments (8825_ATT) <strong>for</strong> otherreporting in<strong>for</strong>mation.Tax Year 2011 33