2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

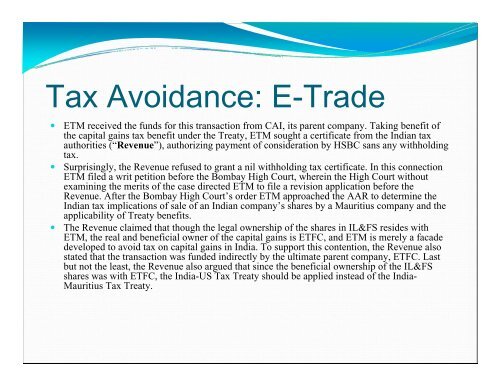

Tax Avoidance: E-Trade• ETM received the funds for this transaction from CAI, its parent company. Taking benefit ofthe capital gains tax benefit under the Treaty, ETM sought a certificate from the Indian taxauthorities (“Revenue”), authorizing payment of consideration by HSBC sans any withholdingtax.• Surprisingly, the Revenue refused to grant a nil withholding tax certificate. In this connectionETM filed a writ petition before the Bombay High Court, wherein the High Court withoutexamining the merits of the case directed ETM to file a revision application before theRevenue. After the Bombay High Court’s order ETM approached the AAR to determine theIndian tax implications of sale of an Indian company’s shares by a Mauritius company and theapplicability of Treaty benefits.• The Revenue claimed that though the legal ownership of the shares in IL&FS resides withETM, the real and beneficial owner of the capital gains is ETFC, and ETM is merely a facadedeveloped to avoid tax on capital gains in India. To support this contention, the Revenue alsostated that the transaction was funded indirectly by the ultimate parent company, ETFC. Lastbut not the least, the Revenue also argued that since the beneficial ownership of the IL&FSshares was with ETFC, the India-US Tax Treaty should be applied instead of the India-Mauritius Tax Treaty.