2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

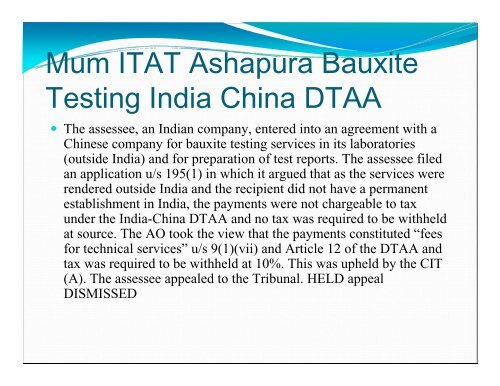

Mum ITAT Ashapura BauxiteTesting India China DTAA• The assessee, an Indian company, entered into an agreement with aChinese company for bauxite testing services in its laboratories(outside India) and for preparation of test reports. The assessee filedan application u/s 195(1) in which it argued that as the services wererendered outside India and the recipient did not have a permanentestablishment in India, the payments were not chargeable to taxunder the India-China DTAA and no tax was required to be withheldat source. The AO took the view that the payments constituted “feesfor technical services” u/s 9(1)(vii) and Article 12 of the DTAA andtax was required to be withheld at 10%. This was upheld by the CIT(A). The assessee appealed to the Tribunal. HELD appealDISMISSED