2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

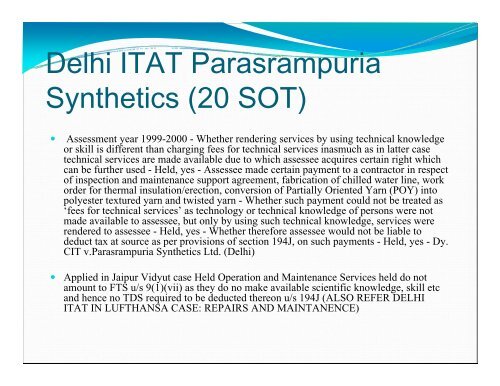

<strong>Delhi</strong> ITAT ParasrampuriaSynthetics (20 SOT)• Assessment year 1999-2000 - Whether rendering services by using technical knowledgeor skill is different than charging fees for technical services inasmuch as in latter casetechnical services are made available due to which assessee acquires certain right whichcan be further used - Held, yes - Assessee made certain payment to a contractor in respectof inspection and maintenance support agreement, fabrication of chilled water line, workorder for thermal insulation/erection, conversion of Partially Oriented Yarn (POY) intopolyester textured yarn and twisted yarn - Whether such payment could not be treated as‘fees for technical services’ as technology or technical knowledge of persons were notmade available to assessee, but only by using such technical knowledge, services wererendered to assessee - Held, yes - Whether therefore assessee would not be liable todeduct tax at source as per provisions of section 194J, on such payments - Held, yes - Dy.CIT v.Parasrampuria Synthetics Ltd. (<strong>Delhi</strong>)• Applied in Jaipur Vidyut case Held Operation and Maintenance Services held do notamount to FTS u/s 9(1)(vii) as they do no make available scientific knowledge, skill etcand hence no TDS required to be deducted thereon u/s 194J (ALSO REFER DELHIITAT IN LUFTHANSA CASE: REPAIRS AND MAINTANENCE)