2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

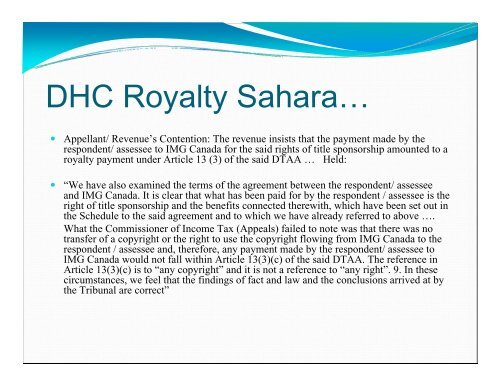

DHC Royalty Sahara…• Appellant/ Revenue’s Contention: The revenue insists that the payment made by therespondent/ assessee to IMG Canada for the said rights of title sponsorship amounted to aroyalty payment under Article 13 (3) of the said DTAA … Held:• “We have also examined the terms of the agreement between the respondent/ assesseeand IMG Canada. It is clear that what has been paid for by the respondent / assessee is theright of title sponsorship and the benefits connected therewith, which have been set out inthe Schedule to the said agreement and to which we have already referred to above ….What the <strong>Com</strong>missioner of Income Tax (Appeals) failed to note was that there was notransfer of a copyright or the right to use the copyright flowing from IMG Canada to therespondent / assessee and, therefore, any payment made by the respondent/ assessee toIMG Canada would not fall within Article 13(3)(c) of the said DTAA. The reference inArticle 13(3)(c) is to “any copyright” and it is not a reference to “any right”. 9. In thesecircumstances, we feel that the findings of fact and law and the conclusions arrived at bythe Tribunal are correct”