2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

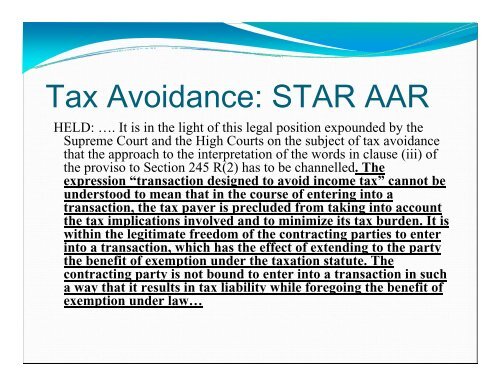

Tax Avoidance: STAR AARHELD: …. It is in the light of this legal position expounded by theSupreme Court and the High Courts on the subject of tax avoidancethat the approach to the interpretation of the words in clause (iii) ofthe proviso to Section 245 R(2) has to be channelled. Theexpression “transaction designed to avoid income tax” cannot beunderstood to mean that in the course of entering into atransaction, the tax payer is precluded from taking into accountthe tax implications involved and to minimize its tax burden. It iswithin the legitimate freedom of the contracting parties to enterinto a transaction, which has the effect of extending to the partythe benefit of exemption under the taxation statute. Thecontracting party is not bound to enter into a transaction in sucha way that it results in tax liability while foregoing the benefit ofexemption under law…