2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

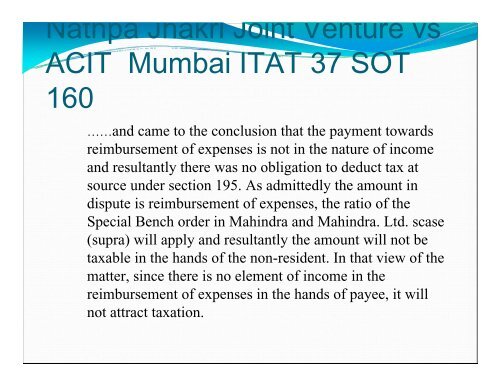

Nathpa Jhakri Joint Venture vsACIT Mumbai ITAT 37 SOT160……and came to the conclusion that the payment towardsreimbursement of expenses is not in the nature of incomeand resultantly there was no obligation to deduct tax atsource under section 195. As admittedly the amount indispute is reimbursement of expenses, the ratio of theSpecial Bench order in Mahindra and Mahindra. Ltd. scase(supra) will apply and resultantly the amount will not betaxable in the hands of the non-resident. In that view of thematter, since there is no element of income in thereimbursement of expenses in the hands of payee, it willnot attract taxation.