2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

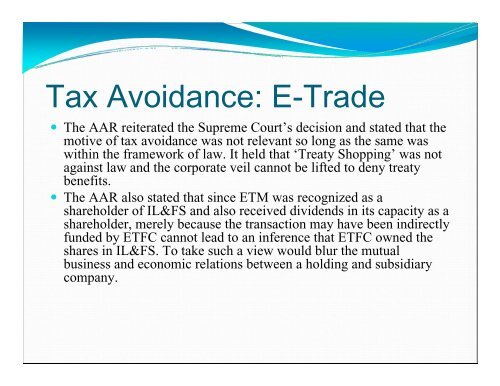

Tax Avoidance: E-Trade• The AAR reiterated the Supreme Court’s decision and stated that themotive of tax avoidance was not relevant so long as the same waswithin the framework of law. It held that ‘Treaty Shopping’ was notagainst law and the corporate veil cannot be lifted to deny treatybenefits.• The AAR also stated that since ETM was recognized as ashareholder of IL&FS and also received dividends in its capacity as ashareholder, merely because the transaction may have been indirectlyfunded by ETFC cannot lead to an inference that ETFC owned theshares in IL&FS. To take such a view would blur the mutualbusiness and economic relations between a holding and subsidiarycompany.