2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

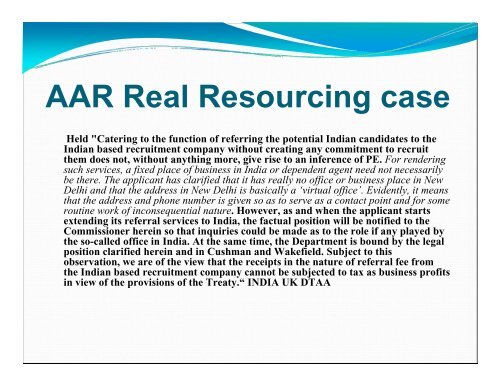

AAR Real Resourcing caseHeld "Catering to the function of referring the potential Indian candidates to theIndian based recruitment company without creating any commitment to recruitthem does not, without anything more, give rise to an inference of PE. For renderingsuch services, a fixed place of business in India or dependent agent need not necessarilybe there. The applicant has clarified that it has really no office or business place in New<strong>Delhi</strong> and that the address in New <strong>Delhi</strong> is basically a ‘virtual office’. Evidently, it meansthat the address and phone number is given so as to serve as a contact point and for someroutine work of inconsequential nature. However, as and when the applicant startsextending its referral services to India, the factual position will be notified to the<strong>Com</strong>missioner herein so that inquiries could be made as to the role if any played bythe so-called office in India. At the same time, the Department is bound by the legalposition clarified herein and in Cushman and Wakefield. Subject to thisobservation, we are of the view that the receipts in the nature of referral fee fromthe Indian based recruitment company cannot be subjected to tax as business profitsin view of the provisions of the Treaty.“ INDIA UK DTAA