2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

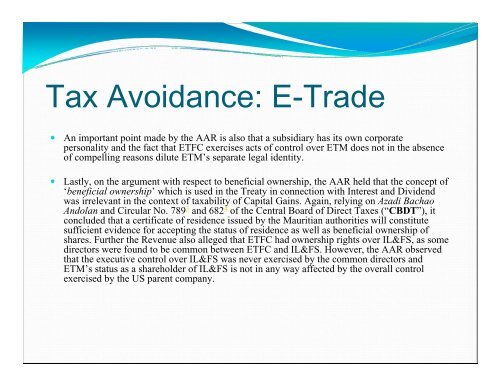

Tax Avoidance: E-Trade• An important point made by the AAR is also that a subsidiary has its own corporatepersonality and the fact that ETFC exercises acts of control over ETM does not in the absenceof compelling reasons dilute ETM’s separate legal identity.• Lastly, on the argument with respect to beneficial ownership, the AAR held that the concept of‘beneficial ownership’ which is used in the Treaty in connection with Interest and Dividendwas irrelevant in the context of taxability of Capital Gains. Again, relying on Azadi BachaoAndolan and Circular No. 789 3 and 682 4 of the Central Board of Direct Taxes (“CBDT”), itconcluded that a certificate of residence issued by the Mauritian authorities will constitutesufficient evidence for accepting the status of residence as well as beneficial ownership ofshares. Further the Revenue also alleged that ETFC had ownership rights over IL&FS, as somedirectors were found to be common between ETFC and IL&FS. However, the AAR observedthat the executive control over IL&FS was never exercised by the common directors andETM’s status as a shareholder of IL&FS is not in any way affected by the overall controlexercised by the US parent company.