2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

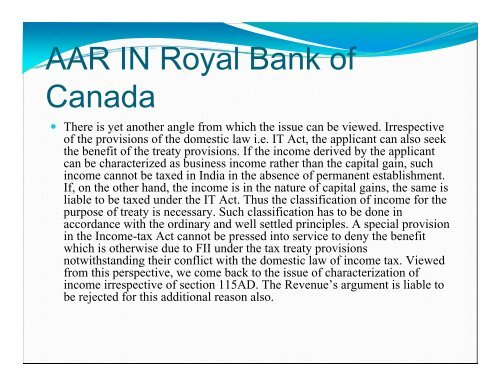

AAR IN Royal Bank ofCanada• There is yet another angle from which the issue can be viewed. Irrespectiveof the provisions of the domestic law i.e. IT Act, the applicant can also seekthe benefit of the treaty provisions. If the income derived by the applicantcan be characterized as business income rather than the capital gain, suchincome cannot be taxed in India in the absence of permanent establishment.If, on the other hand, the income is in the nature of capital gains, the same isliable to be taxed under the IT Act. Thus the classification of income for thepurpose of treaty is necessary. Such classification has to be done inaccordance with the ordinary and well settled principles. A special provisionin the Income-tax Act cannot be pressed into service to deny the benefitwhich is otherwise due to FII under the tax treaty provisionsnotwithstanding their conflict with the domestic law of income tax. Viewedfrom this perspective, we come back to the issue of characterization ofincome irrespective of section 115AD. The Revenue’s argument is liable tobe rejected for this additional reason also.