2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

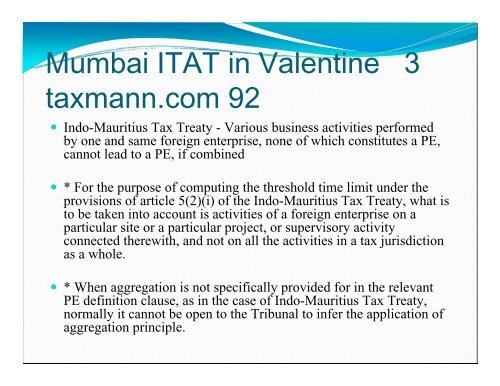

Mumbai ITAT in Valentine 3taxmann.com 92• Indo-Mauritius Tax Treaty - Various business activities performedby one and same foreign enterprise, none of which constitutes a PE,cannot lead to a PE, if combined• * For the purpose of computing the threshold time limit under theprovisions of article 5(2)(i) of the Indo-Mauritius Tax Treaty, what isto be taken into account is activities of a foreign enterprise on aparticular site or a particular project, or supervisory activityconnected therewith, and not on all the activities in a tax jurisdictionas a whole.• * When aggregation is not specifically provided for in the relevantPE definition clause, as in the case of Indo-Mauritius Tax Treaty,normally it cannot be open to the Tribunal to infer the application ofaggregation principle.