2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

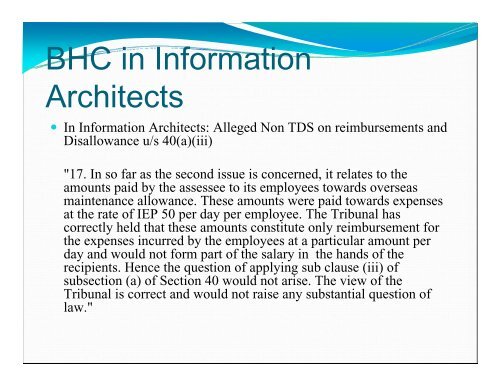

BHC in InformationArchitects• In Information Architects: Alleged Non TDS on reimbursements andDisallowance u/s 40(a)(iii)"17. In so far as the second issue is concerned, it relates to theamounts paid by the assessee to its employees towards overseasmaintenance allowance. These amounts were paid towards expensesat the rate of IEP 50 per day per employee. The Tribunal hascorrectly held that these amounts constitute only reimbursement forthe expenses incurred by the employees at a particular amount perday and would not form part of the salary in the hands of therecipients. Hence the question of applying sub clause (iii) ofsubsection (a) of Section 40 would not arise. The view of theTribunal is correct and would not raise any substantial question oflaw."