2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

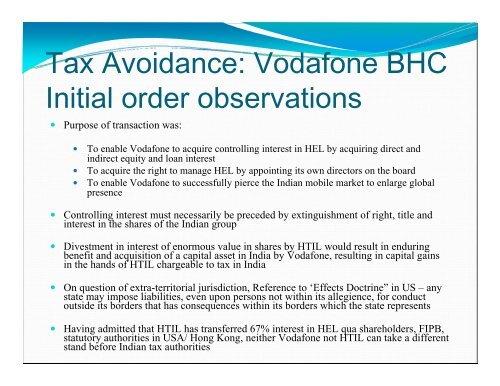

Tax Avoidance: Vodafone BHCInitial order observations• Purpose of transaction was:• To enable Vodafone to acquire controlling interest in HEL by acquiring direct andindirect equity and loan interest• To acquire the right to manage HEL by appointing its own directors on the board• To enable Vodafone to successfully pierce the Indian mobile market to enlarge globalpresence• Controlling interest must necessarily be preceded by extinguishment of right, title andinterest in the shares of the Indian group• Divestment in interest of enormous value in shares by HTIL would result in enduringbenefit and acquisition of a capital asset in India by Vodafone, resulting in capital gainsin the hands of HTIL chargeable to tax in India• On question of extra-territorial jurisdiction, Reference to ‘Effects Doctrine” in US – anystate may impose liabilities, even upon persons not within its allegience, for conductoutside its borders that has consequences within its borders which the state represents• Having admitted that HTIL has transferred 67% interest in HEL qua shareholders, FIPB,statutory authorities in USA/ Hong Kong, neither Vodafone not HTIL can take a differentstand before Indian tax authorities