2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

2 July 2010,Friday Kapil Goel B.Com(H) FCA LLB Advocate Delhi ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

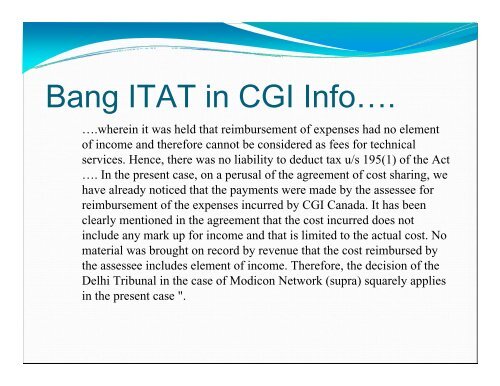

Bang ITAT in CGI Info….….wherein it was held that reimbursement of expenses had no elementof income and therefore cannot be considered as fees for technicalservices. Hence, there was no liability to deduct tax u/s 195(1) of the Act…. In the present case, on a perusal of the agreement of cost sharing, wehave already noticed that the payments were made by the assessee forreimbursement of the expenses incurred by CGI Canada. It has beenclearly mentioned in the agreement that the cost incurred does notinclude any mark up for income and that is limited to the actual cost. Nomaterial was brought on record by revenue that the cost reimbursed bythe assessee includes element of income. Therefore, the decision of the<strong>Delhi</strong> Tribunal in the case of Modicon Network (supra) squarely appliesin the present case ".