Self-help Groups as Financial Intermediaries in India ... - Sa-Dhan

Self-help Groups as Financial Intermediaries in India ... - Sa-Dhan

Self-help Groups as Financial Intermediaries in India ... - Sa-Dhan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

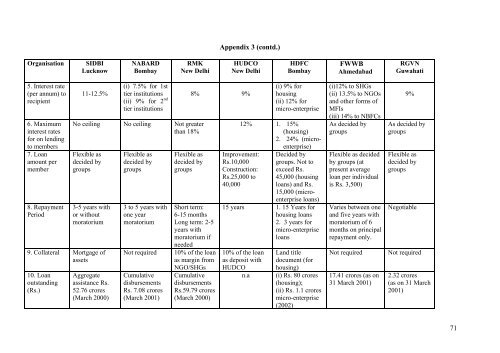

Appendix 3 (contd.)OrganisationSIDBILucknowNABARDBombayRMKNew DelhiHUDCONew DelhiHDFCBombayFWWBAhmedabadRGVNGuwahati5. Interest rate(per annum) torecipient6. Maximum<strong>in</strong>terest ratesfor on lend<strong>in</strong>gto members7. Loanamount permember8. RepaymentPeriod11-12.5%(i) 7.5% for 1sttier <strong>in</strong>stitutions(ii) 9% for 2 ndtier <strong>in</strong>stitutionsNo ceil<strong>in</strong>g No ceil<strong>in</strong>g Not greaterthan 18%Flexible <strong>as</strong>decided bygroups3-5 years withor withoutmoratorium9. Collateral Mortgage of<strong>as</strong>sets10. Loanoutstand<strong>in</strong>g(Rs.)Aggregate<strong>as</strong>sistance Rs.52.76 crores(March 2000)Flexible <strong>as</strong>decided bygroups3 to 5 years withone yearmoratoriumNot requiredCumulativedisbursementsRs. 7.08 crores(March 2001)Flexible <strong>as</strong>decided bygroups8% 9%Short term:6-15 monthsLong term: 2-5years withmoratorium ifneeded10% of the loan<strong>as</strong> marg<strong>in</strong> fromNGO/SHGsCumulativedisbursementsRs.59.79 crores(March 2000)12%Improvement:Rs.10,000Construction:Rs.25,000 to40,000(i) 9% forhous<strong>in</strong>g(ii) 12% formicro-enterprise1. 15%(hous<strong>in</strong>g)2. 24% (microenterprise)Decided bygroups. Not toexceed Rs.45,000 (hous<strong>in</strong>gloans) and Rs.15,000 (microenterpriseloans)15 years 1. 15 Years forhous<strong>in</strong>g loans2. 3 years formicro-enterpriseloans10% of the loan<strong>as</strong> deposit withHUDCOn.aLand titledocument (forhous<strong>in</strong>g)(i) Rs. 80 crores(hous<strong>in</strong>g);(ii) Rs. 1.1 croresmicro-enterprise(2002)(i)12% to SHGs(ii) 13.5% to NGOsand other forms ofMFIs(iii) 14% to NBFCsAs decided bygroupsFlexible <strong>as</strong> decidedby groups (atpresent averageloan per <strong>in</strong>dividualis Rs. 3,500)Varies between oneand five years withmoratorium of 6months on pr<strong>in</strong>cipalrepayment only.Not required17.41 crores (<strong>as</strong> on31 March 2001)9%As decided bygroupsFlexible <strong>as</strong>decided bygroupsNegotiableNot required2.32 crores(<strong>as</strong> on 31 March2001)71