GC Catalog 2011 2012 - Gaston College

GC Catalog 2011 2012 - Gaston College

GC Catalog 2011 2012 - Gaston College

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

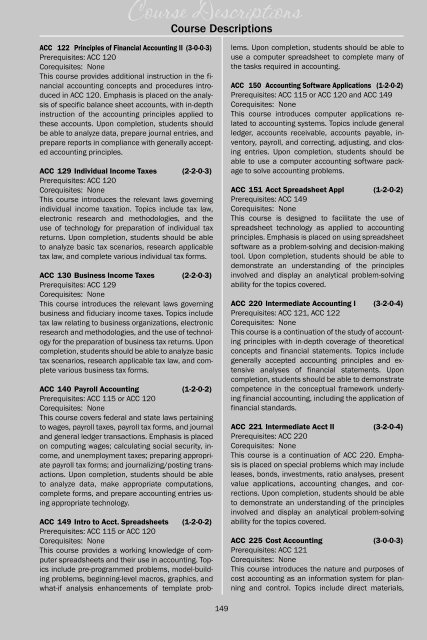

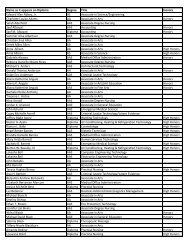

Course DescriptionsCourse DescriptionsACC 122 Principles of Financial Accounting II (3-0-0-3)Prerequisites: ACC 120Corequisites: NoneThis course provides additional instruction in the financialaccounting concepts and procedures introducedin ACC 120. Emphasis is placed on the analysisof specific balance sheet accounts, with in-depthinstruction of the accounting principles applied tothese accounts. Upon completion, students shouldbe able to analyze data, prepare journal entries, andprepare reports in compliance with generally acceptedaccounting principles.ACC 129 Individual Income Taxes (2-2-0-3)Prerequisites: ACC 120Corequisites: NoneThis course introduces the relevant laws governingindividual income taxation. Topics include tax law,electronic research and methodologies, and theuse of technology for preparation of individual taxreturns. Upon completion, students should be ableto analyze basic tax scenarios, research applicabletax law, and complete various individual tax forms.ACC 130 Business Income Taxes (2-2-0-3)Prerequisites: ACC 129Corequisites: NoneThis course introduces the relevant laws governingbusiness and fiduciary income taxes. Topics includetax law relating to business organizations, electronicresearch and methodologies, and the use of technologyfor the preparation of business tax returns. Uponcompletion, students should be able to analyze basictax scenarios, research applicable tax law, and completevarious business tax forms.ACC 140 Payroll Accounting (1-2-0-2)Prerequisites: ACC 115 or ACC 120Corequisites: NoneThis course covers federal and state laws pertainingto wages, payroll taxes, payroll tax forms, and journaland general ledger transactions. Emphasis is placedon computing wages; calculating social security, income,and unemployment taxes; preparing appropriatepayroll tax forms; and journalizing/posting transactions.Upon completion, students should be ableto analyze data, make appropriate computations,complete forms, and prepare accounting entries usingappropriate technology.ACC 149 Intro to Acct. Spreadsheets (1-2-0-2)Prerequisites: ACC 115 or ACC 120Corequisites: NoneThis course provides a working knowledge of computerspreadsheets and their use in accounting. Topicsinclude pre-programmed problems, model-buildingproblems, beginning-level macros, graphics, andwhat-if analysis enhancements of template problems.Upon completion, students should be able touse a computer spreadsheet to complete many ofthe tasks required in accounting.ACC 150 Accounting Software Applications (1-2-0-2)Prerequisites: ACC 115 or ACC 120 and ACC 149Corequisites: NoneThis course introduces computer applications relatedto accounting systems. Topics include generalledger, accounts receivable, accounts payable, inventory,payroll, and correcting, adjusting, and closingentries. Upon completion, students should beable to use a computer accounting software packageto solve accounting problems.ACC 151 Acct Spreadsheet Appl (1-2-0-2)Prerequisites: ACC 149Corequisites: NoneThis course is designed to facilitate the use ofspreadsheet technology as applied to accountingprinciples. Emphasis is placed on using spreadsheetsoftware as a problem-solving and decision-makingtool. Upon completion, students should be able todemonstrate an understanding of the principlesinvolved and display an analytical problem-solvingability for the topics covered.ACC 220 Intermediate Accounting I (3-2-0-4)Prerequisites: ACC 121, ACC 122Corequisites: NoneThis course is a continuation of the study of accountingprinciples with in-depth coverage of theoreticalconcepts and financial statements. Topics includegenerally accepted accounting principles and extensiveanalyses of financial statements. Uponcompletion, students should be able to demonstratecompetence in the conceptual framework underlyingfinancial accounting, including the application offinancial standards.ACC 221 Intermediate Acct II (3-2-0-4)Prerequisites: ACC 220Corequisites: NoneThis course is a continuation of ACC 220. Emphasisis placed on special problems which may includeleases, bonds, investments, ratio analyses, presentvalue applications, accounting changes, and corrections.Upon completion, students should be ableto demonstrate an understanding of the principlesinvolved and display an analytical problem-solvingability for the topics covered.ACC 225 Cost Accounting (3-0-0-3)Prerequisites: ACC 121Corequisites: NoneThis course introduces the nature and purposes ofcost accounting as an information system for planningand control. Topics include direct materials,149