Environmental and social transparency under the ... - ClientEarth

Environmental and social transparency under the ... - ClientEarth

Environmental and social transparency under the ... - ClientEarth

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

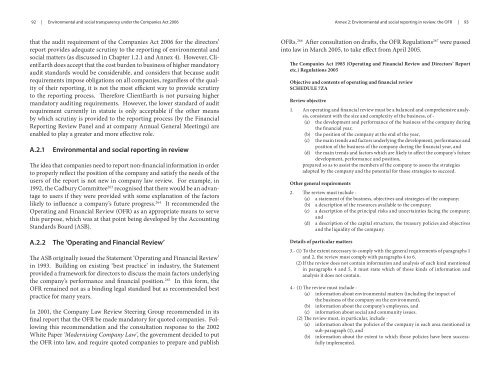

92 | <strong>Environmental</strong> <strong>and</strong> <strong>social</strong> <strong>transparency</strong> <strong>under</strong> <strong>the</strong> Companies Act 2006Annex 2: <strong>Environmental</strong> <strong>and</strong> <strong>social</strong> reporting in review: <strong>the</strong> OFR | 93that <strong>the</strong> audit requirement of <strong>the</strong> Companies Act 2006 for <strong>the</strong> directors’report provides adequate scrutiny to <strong>the</strong> reporting of environmental <strong>and</strong><strong>social</strong> matters (as discussed in Chapter 1.2.1 <strong>and</strong> Annex 4). However, <strong>ClientEarth</strong>does accept that <strong>the</strong> cost burden to business of higher m<strong>and</strong>atoryaudit st<strong>and</strong>ards would be considerable, <strong>and</strong> considers that because auditrequirements impose obligations on all companies, regardless of <strong>the</strong> qualityof <strong>the</strong>ir reporting, it is not <strong>the</strong> most efficient way to provide scrutinyto <strong>the</strong> reporting process. Therefore <strong>ClientEarth</strong> is not pursuing higherm<strong>and</strong>atory auditing requirements. However, <strong>the</strong> lower st<strong>and</strong>ard of auditrequirement currently in statute is only acceptable if <strong>the</strong> o<strong>the</strong>r meansby which scrutiny is provided to <strong>the</strong> reporting process (by <strong>the</strong> FinancialReporting Review Panel <strong>and</strong> at company Annual General Meetings) areenabled to play a greater <strong>and</strong> more effective role.A.2.1<strong>Environmental</strong> <strong>and</strong> <strong>social</strong> reporting in reviewThe idea that companies need to report non-financial information in orderto properly reflect <strong>the</strong> position of <strong>the</strong> company <strong>and</strong> satisfy <strong>the</strong> needs of <strong>the</strong>users of <strong>the</strong> report is not new in company law review. For example, in1992, <strong>the</strong> Cadbury Committee 263 recognised that <strong>the</strong>re would be an advantageto users if <strong>the</strong>y were provided with some explanation of <strong>the</strong> factorslikely to influence a company’s future progress. 264 It recommended <strong>the</strong>Operating <strong>and</strong> Financial Review (OFR) as an appropriate means to servethis purpose, which was at that point being developed by <strong>the</strong> AccountingSt<strong>and</strong>ards Board (ASB).A.2.2The ‘Operating <strong>and</strong> Financial Review’The ASB originally issued <strong>the</strong> Statement ‘Operating <strong>and</strong> Financial Review’in 1993. Building on existing ‘best practice’ in industry, <strong>the</strong> Statementprovided a framework for directors to discuss <strong>the</strong> main factors <strong>under</strong>lying<strong>the</strong> company’s performance <strong>and</strong> financial position. 265 In this form, <strong>the</strong>OFR remained not as a binding legal st<strong>and</strong>ard but as recommended bestpractice for many years.In 2001, <strong>the</strong> Company Law Review Steering Group recommended in itsfinal report that <strong>the</strong> OFR be made m<strong>and</strong>atory for quoted companies. Followingthis recommendation <strong>and</strong> <strong>the</strong> consultation response to <strong>the</strong> 2002White Paper ‘Modernising Company Law’, <strong>the</strong> government decided to put<strong>the</strong> OFR into law, <strong>and</strong> require quoted companies to prepare <strong>and</strong> publishOFRs. 266 After consultation on drafts, <strong>the</strong> OFR Regulations 267 were passedinto law in March 2005, to take effect from April 2005.The Companies Act 1985 (Operating <strong>and</strong> Financial Review <strong>and</strong> Directors’ Reportetc.) Regulations 2005Objective <strong>and</strong> contents of operating <strong>and</strong> financial reviewSCHEDULE 7ZAReview objective1. An operating <strong>and</strong> financial review must be a balanced <strong>and</strong> comprehensive analysis,consistent with <strong>the</strong> size <strong>and</strong> complexity of <strong>the</strong> business, of -(a) <strong>the</strong> development <strong>and</strong> performance of <strong>the</strong> business of <strong>the</strong> company during<strong>the</strong> financial year,(b) <strong>the</strong> position of <strong>the</strong> company at <strong>the</strong> end of <strong>the</strong> year,(c) <strong>the</strong> main trends <strong>and</strong> factors <strong>under</strong>lying <strong>the</strong> development, performance <strong>and</strong>position of <strong>the</strong> business of <strong>the</strong> company during <strong>the</strong> financial year, <strong>and</strong>(d) <strong>the</strong> main trends <strong>and</strong> factors which are likely to affect <strong>the</strong> company’s futuredevelopment, performance <strong>and</strong> position,prepared so as to assist <strong>the</strong> members of <strong>the</strong> company to assess <strong>the</strong> strategiesadopted by <strong>the</strong> company <strong>and</strong> <strong>the</strong> potential for those strategies to succeed.O<strong>the</strong>r general requirements2. The review must include -(a) a statement of <strong>the</strong> business, objectives <strong>and</strong> strategies of <strong>the</strong> company;(b) a description of <strong>the</strong> resources available to <strong>the</strong> company;(c) a description of <strong>the</strong> principal risks <strong>and</strong> uncertainties facing <strong>the</strong> company;<strong>and</strong>(d) a description of <strong>the</strong> capital structure, <strong>the</strong> treasury policies <strong>and</strong> objectives<strong>and</strong> <strong>the</strong> liquidity of <strong>the</strong> company.Details of particular matters3.- (1) To <strong>the</strong> extent necessary to comply with <strong>the</strong> general requirements of paragraphs 1<strong>and</strong> 2, <strong>the</strong> review must comply with paragraphs 4 to 6.(2) If <strong>the</strong> review does not contain information <strong>and</strong> analysis of each kind mentionedin paragraphs 4 <strong>and</strong> 5, it must state which of those kinds of information <strong>and</strong>analysis it does not contain.4.- (1) The review must include -(a) information about environmental matters (including <strong>the</strong> impact of<strong>the</strong> business of <strong>the</strong> company on <strong>the</strong> environment),(b) information about <strong>the</strong> company’s employees, <strong>and</strong>(c) information about <strong>social</strong> <strong>and</strong> community issues.(2) The review must, in particular, include -(a) information about <strong>the</strong> policies of <strong>the</strong> company in each area mentioned insub-paragraph (1), <strong>and</strong>(b) information about <strong>the</strong> extent to which those policies have been successfullyimplemented.