Annual Report 2011 - Sydney Opera House

Annual Report 2011 - Sydney Opera House

Annual Report 2011 - Sydney Opera House

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

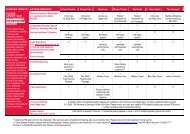

66earning our wayimagination lives insidefinancial overviewOverall group result is a loss for the year of $5.0m. This comprises a profitfrom general operations of $3.2m and a net profit of $7.1m from buildingdevelopment and maintenance, offset fully by depreciation expense of $15.3m.The overall loss reflects the high depreciation associated with the <strong>Sydney</strong><strong>Opera</strong> <strong>House</strong> asset base, which has a value in excess of $2 billion.OVERVIEW To maintain sufficient cashreserves for general operations, <strong>Sydney</strong><strong>Opera</strong> <strong>House</strong> actively prioritises fundingrequests to ensure sustainable operationslonger term. During 2010/11 the generaloperating cash flow was $2.8m, with the2010/11 general operations profit of $3.2moffset by investment in capital assetsof $0.4m. The strong general operatingprofit was achieved with cost control,a number of one-off upsides, increasedactivity levels across the businessand the conscious deferral of $1.5mproject expenditure into future years.Expenditure on building maintenanceand building development continued to befunded 100% by government grants withany profit due to combination of timingissues and the capitalisation of $14.0min 2010/11 of building maintenance anddevelopment expenditure.Holding adequate cash reserves is animportant risk strategy in ensuringcapacity to maintain operations giventhe volatility in global and domesticmarkets, as well as to manage potentialrisks associated with around the clockbuilding operations. General operatingcash reserves at $12.5m are not large;they represent only 13.4% of operatingactivities revenue and are immaterial interms of <strong>Sydney</strong> <strong>Opera</strong> <strong>House</strong>’s asset basein excess of $2 billion.General <strong>Opera</strong>tions <strong>Opera</strong>ting revenuesincreased by 16% or $13.1m on the prioryear. Key reasons for this include:- <strong>Opera</strong>ting interest increased by $0.8mor 43% due to higher opening fundsand cash flow profile;- Self Generated Fundraising revenuesincreased by $0.6m or 12% duepredominantly to sponsorshipgrowth; and- Commercial Revenues and OtherRevenues increased by $11.8m or20% with major movements:> SOH Presents increased by $6.3m dueto increased activity and attendanceduring the year, as in prior years theresult includes Events NSW fundingof $1.2m for Vivid LIVE <strong>2011</strong>.> Venue related revenues increased$2.9m or 15% reflecting increasedactivity levels, aided by a strongForecourt season.> Food and Beverage increased by$1.1m or 23% due to increasedpatronage and new food andbeverage offerings on site.<strong>Sydney</strong> <strong>Opera</strong> <strong>House</strong>, its residentcompanies and other presenters continueto have an important role in the performingarts, supporting a range of artists andpresenting both classic and new works thatengage and inspire audiences.- overall 1,795 performances werepresented to an audience of 1,318,525,an increase of 3.6% in attendance overthe prior year;- the four major resident companiespresented 571 performances covering