Annual Report 2011 - Sydney Opera House

Annual Report 2011 - Sydney Opera House

Annual Report 2011 - Sydney Opera House

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

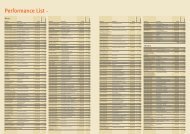

84SYDNEY OPERA HOUSE TRUSTnotes TO AND FORMING PART OF THE FINANCIAL STATEMENTS(c) MaintenanceComputer hardware maintenance 41 124System and network maintenance 468 437Building and equipmentrepairs and maintenance 19,068 17,93919,577 18,500Plus: Personnel services maintenance charge 6,126 6,525(d) Depreciation, amortisation and make good25,703 25,025DepreciationBuilding and building services - 6,889Plant and equipment 14,203 9,57614,203 16,465AmortisationIntangible assets 349 406Amortisation of leasehold improvements 722 931,071 499pROvisionLease Make Good expense 39 44Change in Accounting Estimates<strong>2011</strong> 2010$’000 $’00015,313 17,008During <strong>2011</strong> the estimated total useful lives of certain items ofBuilding Services were revised. The net effect of the changes inthe current financial year was a decrease in depreciation expenseof $2.107m with no impact on future years.5. TRUSTEES’ REMUNERATIONNo emoluments were paid to the Trustees during the year. TheTrustees resolved to cease being remunerated from 1 January2007. Part of Trustee duties involve attending <strong>Sydney</strong> <strong>Opera</strong><strong>House</strong> Trust events. (2010: Nil)6. CASH AND CASH EQUIVALENTSCash at bank and on hand 4,595 6,447Hour-Glass cash facility 2,056 189Short term deposits 43,000 42,000NSW Treasury Corporationshort term investments 117 116Cash and cash equivalent assets recognised in the Balance Sheetare reconciled at the end of the year to the Cash Flow Statementas follows:Cash and cash equivalents 49,768 48,752Refer note 17 for details regarding interest rate risk and asensitivity analysis for financial assets and liabilities.7. TRADE AND OTHER RECEIVABLESTrade receivables 1,394 1,628Allowance for impairment of receivables (47) (85)Accrued Income 851 1,402Other receivables 1,000 7883,198 3,733Refer note 17 for details regarding exposure to credit andcurrency risk and impairment losses related to trade and otherreceivables.8. PrepaymentsPrepaid superannuation 1,895 2,181Prepaid expenses 2,289 2,246Prepaid Superannuation<strong>2011</strong> 2010$’000 $’0004,184 4,427The funding position at 30 June <strong>2011</strong> in respect of the threedefined benefits schemes related to personnel services received,namely the State Authorities Superannuation Scheme (SASS), theState Superannuation Scheme (SSS) and the State AuthoritiesNon Contributory Superannuation Scheme (SANCS) has beenadvised by Pillar Administration:Estimated ReservEpREpaidaCCOunt Funds Accrued Liability Contributions<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010$’000 $’000 $’000 $’000 $’000 $’000SASS 7,087 6,498 7,074 6,476 13 22SSS 48,884 46,394 47,010 44,256 1,874 2,138SANCS 1,596 1,488 1,588 1,467 8 2157,567 54,380 55,672 52,199 1,895 2,18149,768 48,752