Climate change futures: health, ecological and economic dimensions

Climate change futures: health, ecological and economic dimensions

Climate change futures: health, ecological and economic dimensions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

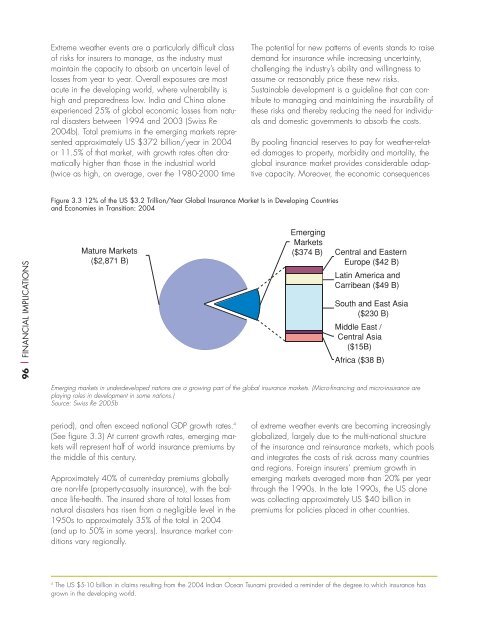

Extreme weather events are a particularly difficult classof risks for insurers to manage, as the industry mustmaintain the capacity to absorb an uncertain level oflosses from year to year. Overall exposures are mostacute in the developing world, where vulnerability ishigh <strong>and</strong> preparedness low. India <strong>and</strong> China aloneexperienced 25% of global <strong>economic</strong> losses from naturaldisasters between 1994 <strong>and</strong> 2003 (Swiss Re2004b). Total premiums in the emerging markets representedapproximately US $372 billion/year in 2004or 11.5% of that market, with growth rates often dramaticallyhigher than those in the industrial world(twice as high, on average, over the 1980-2000 timeThe potential for new patterns of events st<strong>and</strong>s to raisedem<strong>and</strong> for insurance while increasing uncertainty,challenging the industry’s ability <strong>and</strong> willingness toassume or reasonably price these new risks.Sustainable development is a guideline that can contributeto managing <strong>and</strong> maintaining the insurability ofthese risks <strong>and</strong> thereby reducing the need for individuals<strong>and</strong> domestic governments to absorb the costs.By pooling financial reserves to pay for weather-relateddamages to property, morbidity <strong>and</strong> mortality, theglobal insurance market provides considerable adaptivecapacity. Moreover, the <strong>economic</strong> consequencesFigure 3.3 12% of the US $3.2 Trillion/Year Global Insurance Market Is in Developing Countries<strong>and</strong> Economies in Transition: 200496 | FINANCIAL IMPLICATIONSMature Markets($2,871 B)EmergingMarkets($374 B)Central <strong>and</strong> EasternEurope ($42 B)Latin America <strong>and</strong>Carribean ($49 B)South <strong>and</strong> East Asia($230 B)Middle East /Central Asia($15B)Africa ($38 B)Emerging markets in underdeveloped nations are a growing part of the global insurance markets. (Micro-financing <strong>and</strong> micro-insurance areplaying roles in development in some nations.)Source: Swiss Re 2005bperiod), <strong>and</strong> often exceed national GDP growth rates. 4(See figure 3.3) At current growth rates, emerging marketswill represent half of world insurance premiums bythe middle of this century.Approximately 40% of current-day premiums globallyare non-life (property-casualty insurance), with the balancelife-<strong>health</strong>. The insured share of total losses fromnatural disasters has risen from a negligible level in the1950s to approximately 35% of the total in 2004(<strong>and</strong> up to 50% in some years). Insurance market conditionsvary regionally.of extreme weather events are becoming increasinglyglobalized, largely due to the multi-national structureof the insurance <strong>and</strong> reinsurance markets, which pools<strong>and</strong> integrates the costs of risk across many countries<strong>and</strong> regions. Foreign insurers’ premium growth inemerging markets averaged more than 20% per yearthrough the 1990s. In the late 1990s, the US alonewas collecting approximately US $40 billion inpremiums for policies placed in other countries.4The US $5-10 billion in claims resulting from the 2004 Indian Ocean Tsunami provided a reminder of the degree to which insurance hasgrown in the developing world.