president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

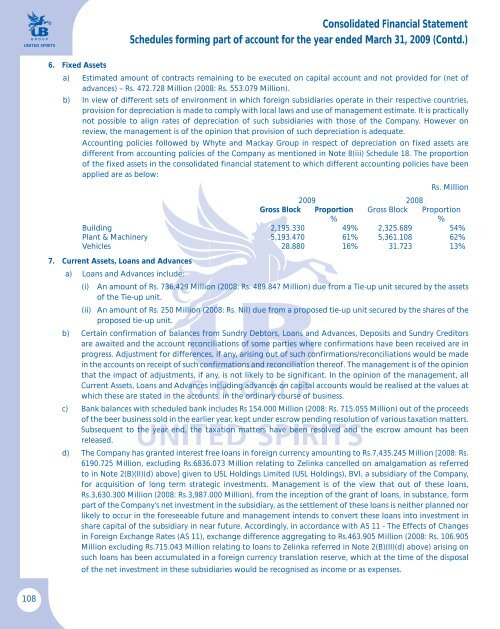

Consolidated Financial StatementSchedules forming part of account for the year ended March 31, 2009 (Contd.)6. Fixed Assetsa) Estimated amount of contracts remaining to be executed on capital account and not provided for (net ofadvances) – Rs. 472.728 Million (2008: Rs. 553.079 Million).b) In view of different sets of environment in which foreign subsidiaries operate in their respective countries,provision for depreciation is made to comply with local laws and use of management estimate. It is practicallynot possible to align rates of depreciation of such subsidiaries with those of the Company. However onreview, the management is of the opinion that provision of such depreciation is adequate.Accounting policies followed by Whyte and Mackay <strong>Group</strong> in respect of depreciation on fixed assets aredifferent from accounting policies of the Company as mentioned in Note 8(iii) Schedule 18. The proportionof the fixed assets in the consolidated financial statement to which different accounting policies have beenapplied are as below:Rs. Million2009 2008Gross Block Proportion%Gross Block Proportion%Building 2,195.330 49% 2,325.689 54%Plant & Machinery 5,193.470 61% 5,361.108 62%Vehicles 28.880 16% 31.723 13%7. Current Assets, Loans and Advancesa) Loans and Advances include:(i)An amount of Rs. 736.429 Million (2008: Rs. 489.847 Million) due from a Tie-up unit secured by the assetsof the Tie-up unit.(ii) An amount of Rs. 250 Million (2008: Rs. Nil) due from a proposed tie-up unit secured by the shares of theproposed tie-up unit.b) Certain confirmation of balances from Sundry Debtors, Loans and Advances, Deposits and Sundry Creditorsare awaited and the account reconciliations of some parties where confirmations have been received are inprogress. Adjustment for differences, if any, arising out of such confirmations/reconciliations would be madein the accounts on receipt of such confirmations and reconciliation thereof. The management is of the opinionthat the impact of adjustments, if any, is not likely to be significant. In the opinion of the management, allCurrent Assets, Loans and Advances including advances on capital accounts would be realised at the values atwhich these are stated in the accounts, in the ordinary course of business.c) Bank balances with scheduled bank includes Rs 154.000 Million (2008: Rs. 715.055 Million) out of the proceedsof the beer business sold in the earlier year, kept under escrow pending resolution of various taxation matters.Subsequent to the year end, the taxation matters have been resolved and the escrow amount has beenreleased.d) The Company has granted interest free loans in foreign currency amounting to Rs.7,435.245 Million [2008: Rs.6190.725 Million, excluding Rs.6836.073 Million relating to Zelinka cancelled on amalgamation as referredto in Note 2(B)(II)(d) above] given to USL Holdings Limited (USL Holdings), BVI, a subsidiary of the Company,for acquisition of long term strategic investments. Management is of the view that out of these loans,Rs.3,630.300 Million (2008: Rs.3,987.000 Million), from the inception of the grant of loans, in substance, formpart of the Company’s net investment in the subsidiary, as the settlement of these loans is neither planned norlikely to occur in the foreseeable future and management intends to convert these loans into investment inshare capital of the subsidiary in near future. Accordingly, in accordance with AS 11 - The Effects of Changesin Foreign Exchange Rates (AS 11), exchange difference aggregating to Rs.463.905 Million (2008: Rs. 106.905Million excluding Rs.715.043 Million relating to loans to Zelinka referred in Note 2(B)(II)(d) above) arising onsuch loans has been accumulated in a foreign currency translation reserve, which at the time of the disposalof the net investment in these subsidiaries would be recognised as income or as expenses.108