president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

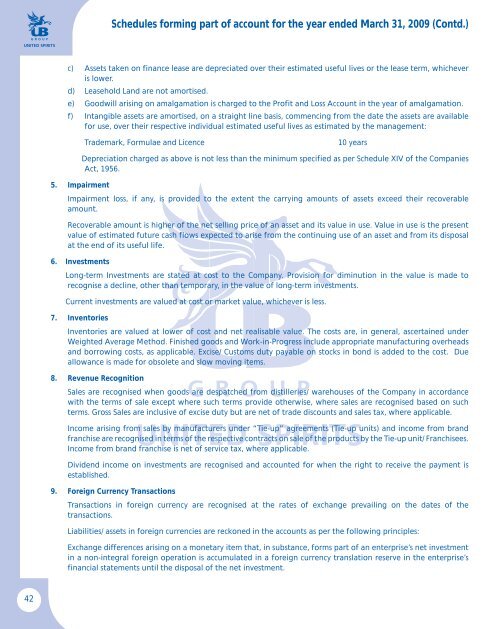

Schedules forming part of account for the year ended March 31, 2009 (Contd.)c) Assets taken on finance lease are depreciated over their estimated useful lives or the lease term, whicheveris lower.d) Leasehold Land are not amortised.e) Goodwill arising on amalgamation is charged to the Profit and Loss Account in the year of amalgamation.f) Intangible assets are amortised, on a straight line basis, commencing from the date the assets are availablefor use, over their respective individual estimated useful lives as estimated by the management:Trademark, Formulae and Licence10 years5. ImpairmentDepreciation charged as above is not less than the minimum specified as per Schedule XIV of the CompaniesAct, 1956.Impairment loss, if any, is provided to the extent the carrying amounts of assets exceed their recoverableamount.Recoverable amount is higher of the net selling price of an asset and its value in use. Value in use is the presentvalue of estimated future cash flows expected to arise from the continuing use of an asset and from its disposalat the end of its useful life.6. InvestmentsLong-term Investments are stated at cost to the Company. Provision for diminution in the value is made torecognise a decline, other than temporary, in the value of long-term investments.Current investments are valued at cost or market value, whichever is less.7. InventoriesInventories are valued at lower of cost and net realisable value. The costs are, in general, ascertained underWeighted Average Method. Finished goods and Work-in-Progress include appropriate manufacturing overheadsand borrowing costs, as applicable. Excise/ Customs duty payable on stocks in bond is added to the cost. Dueallowance is made for obsolete and slow moving items.8. Revenue RecognitionSales are recognised when goods are despatched from distilleries/ warehouses of the Company in accordancewith the terms of sale except where such terms provide otherwise, where sales are recognised based on suchterms. Gross Sales are inclusive of excise duty but are net of trade discounts and sales tax, where applicable.Income arising from sales by manufacturers under “Tie-up” agreements (Tie-up units) and income from brandfranchise are recognised in terms of the respective contracts on sale of the products by the Tie-up unit/ Franchisees.Income from brand franchise is net of service tax, where applicable.Dividend income on investments are recognised and accounted for when the right to receive the payment isestablished.9. Foreign Currency TransactionsTransactions in foreign currency are recognised at the rates of exchange prevailing on the dates of thetransactions.Liabilities/ assets in foreign currencies are reckoned in the accounts as per the following principles:Exchange differences arising on a monetary item that, in substance, forms part of an enterprise’s net investmentin a non-integral foreign operation is accumulated in a foreign currency translation reserve in the enterprise’sfinancial statements until the disposal of the net investment.42