Schedules forming part of account for the year ended March 31, 2009 (Contd.)6. Investment (Contd.)b) Investment in USL Benefit Trust represents beneficial interest in USL Benefit Trust which holds 13,741,643(2008: 2,152,659) equity shares of Rs 10 each of the Company, with all additions or accretions thereto in trustfor the benefit of the Company. The above includes 10,282,533 shares held by erstwhile SWCL, a transferorcompany, in the Company referred to in Note 2 (A) (III) above.c) The carrying cost of investment in Palmer Investment <strong>Group</strong> Limited amounting to Rs. 6,917.801 Million,substantially exceeds the net worth and the market value of shares held directly and indirectly throughsubsidiary, by it. The management of the Company believes that this reflects intrinsic value far in excess ofthe carrying cost of investments and that such shortfall in net worth / decline in market value of such sharesis purely temporary in nature and, hence, no provision is considered necessary for the same.7. Disclosures of dues/payments to Micro and Small enterprises to the extent such enterprises are identified by theCompany.Rs. Million2009 2008a) (i) The principal amount remaining unpaid as at March 31, 2009 32.359 10.242(ii) Interest due thereon remaining unpaid on March 31, 2009 0.047 -b) The amount of interest paid by the Company in terms of section 16 of the Micro,Small and Medium Enterprises Development Act, 2006, along with the amountof the payment made to the supplier beyond the appointed day during eachaccounting year:(i) Delayed payments of principal beyond the appointed date during theentire accounting year 132.355 -(ii) Interest actually paid under Section 16 of the Micro, Small and Medium'Enterprises Development Act, 2006 - -c) The amount of interest due and payable for the period of delay in makingpayment (which have been paid but beyond the appointed day during theyear) but without adding the interest specified under the Micro, Small andMedium 'Enterprises Development Act, 2006 - -d) The amount of interest accrued and remaining unpaid on March 31, 2009 inrespect of principal amount settled during the year 2.037 -e) The amount of further interest remaining due and payable even in thesucceeding years, until such date when the interest dues as above are actuallypaid to the small enterprise, for the purpose of disallowance as a deductibleexpenditure under Section 23 of the Micro, Small and Medium 'EnterprisesDevelopment Act, 2006. - -The above information has been determined to the extent such parties have been identified on the basis ofinformation provided by the Company, which has been relied upon by the auditors.8. As required under Section 205C of the Companies Act, 1956, the Company has transferred Rs. 4.678 Million(2008 : Rs. 10.517 Million) to the Investor Education and Protection Fund (IEPF) during the year. On March 31,2009, no amount was due for transfer to the IEPF.9. Interest on inter corporate deposit included under Unsecured Loan – Other in Schedule 4 acquired onamalgamation, where negotiation/ settlement has not been finalised, has been provided in terms of the decreeand / or otherwise considered adequate by the management. In the opinion of the management, interest so farprovided is adequate and no further provision is necessary in this respect. Adjustments, if any, are carried out asand when the amounts are determined on final disposal / settlement of the matter.54

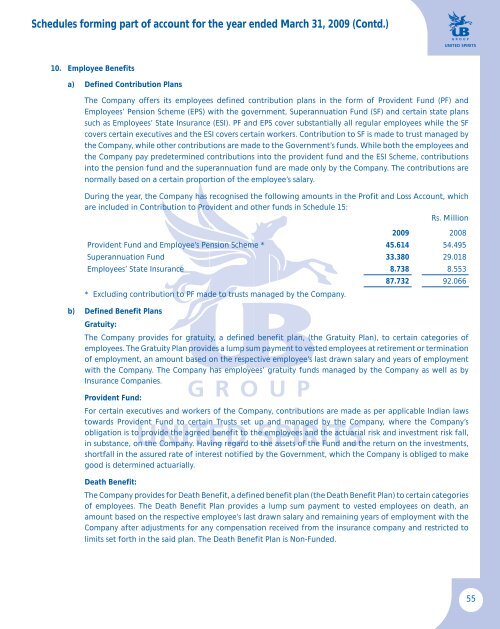

Schedules forming part of account for the year ended March 31, 2009 (Contd.)10. Employee Benefitsa) Defined Contribution PlansThe Company offers its employees defined contribution plans in the form of Provident Fund (PF) andEmployees’ Pension Scheme (EPS) with the government, Superannuation Fund (SF) and certain state planssuch as Employees’ State Insurance (ESI). PF and EPS cover substantially all regular employees while the SFcovers certain executives and the ESI covers certain workers. Contribution to SF is made to trust managed bythe Company, while other contributions are made to the Government’s funds. While both the employees andthe Company pay predetermined contributions into the provident fund and the ESI Scheme, contributionsinto the pension fund and the superannuation fund are made only by the Company. The contributions arenormally based on a certain proportion of the employee’s salary.During the year, the Company has recognised the following amounts in the Profit and Loss Account, whichare included in Contribution to Provident and other funds in Schedule 15:Rs. Million2009 2008Provident Fund and Employee’s Pension Scheme * 45.614 54.495Superannuation Fund 33.380 29.018Employees’ State Insurance 8.738 8.553* Excluding contribution to PF made to trusts managed by the Company.b) Defined Benefit PlansGratuity:87.732 92.066The Company provides for gratuity, a defined benefit plan, (the Gratuity Plan), to certain categories ofemployees. The Gratuity Plan provides a lump sum payment to vested employees at retirement or terminationof employment, an amount based on the respective employee’s last drawn salary and years of employmentwith the Company. The Company has employees’ gratuity funds managed by the Company as well as byInsurance Companies.Provident Fund:For certain executives and workers of the Company, contributions are made as per applicable Indian lawstowards Provident Fund to certain Trusts set up and managed by the Company, where the Company’sobligation is to provide the agreed benefit to the employees and the actuarial risk and investment risk fall,in substance, on the Company. Having regard to the assets of the Fund and the return on the investments,shortfall in the assured rate of interest notified by the Government, which the Company is obliged to makegood is determined actuarially.Death Benefit:The Company provides for Death Benefit, a defined benefit plan (the Death Benefit Plan) to certain categoriesof employees. The Death Benefit Plan provides a lump sum payment to vested employees on death, anamount based on the respective employee’s last drawn salary and remaining years of employment with theCompany after adjustments for any compensation received from the insurance company and restricted tolimits set forth in the said plan. The Death Benefit Plan is Non-Funded.55