president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

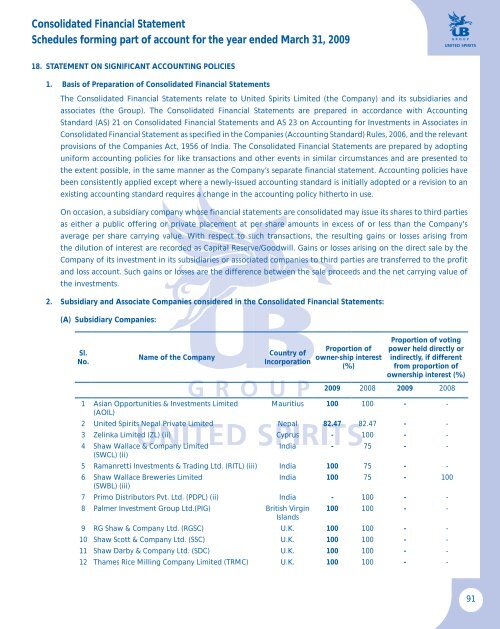

Consolidated Financial StatementSchedules forming part of account for the year ended March 31, 200918. STATEmENT ON SIGNIfIcANT AccOUNTING POLIcIEs1. Basis of Preparation of Consolidated Financial StatementsThe Consolidated Financial Statements relate to United Spirits Limited (the Company) and its subsidiaries andassociates (the <strong>Group</strong>). The Consolidated Financial Statements are prepared in accordance with AccountingStandard (AS) 21 on Consolidated Financial Statements and AS 23 on Accounting for Investments in Associates inConsolidated Financial Statement as specified in the Companies (Accounting Standard) Rules, 2006, and the relevantprovisions of the Companies Act, 1956 of India. The Consolidated Financial Statements are prepared by adoptinguniform accounting policies for like transactions and other events in similar circumstances and are presented tothe extent possible, in the same manner as the Company’s separate financial statement. Accounting policies havebeen consistently applied except where a newly-issued accounting standard is initially adopted or a revision to anexisting accounting standard requires a change in the accounting policy hitherto in use.On occasion, a subsidiary company whose financial statements are consolidated may issue its shares to third partiesas either a public offering or private placement at per share amounts in excess of or less than the Company'saverage per share carrying value. With respect to such transactions, the resulting gains or losses arising fromthe dilution of interest are recorded as Capital Reserve/Goodwill. Gains or losses arising on the direct sale by theCompany of its investment in its subsidiaries or associated companies to third parties are transferred to the profitand loss account. Such gains or losses are the difference between the sale proceeds and the net carrying value ofthe investments.2. Subsidiary and Associate Companies considered in the Consolidated Financial Statements:(A) Subsidiary Companies:Sl.No.Name of the CompanyCountry ofIncorporationProportion ofowner-ship interest(%)Proportion of votingpower held directly orindirectly, if differentfrom proportion ofownership interest (%)2009 2008 2009 20081 Asian Opportunities & Investments Limited(AOIL)Mauritius 100 100 - -2 United Spirits Nepal Private Limited Nepal 82.47 82.47 - -3 Zelinka Limited (ZL) (ii) Cyprus - 100 - -4 Shaw Wallace & Company Limited(SWCL) (ii)India - 75 - -5 Ramanretti Investments & Trading Ltd. (RITL) (iii) India 100 75 - -6 Shaw Wallace Breweries Limited(SWBL) (iii)India 100 75 - 1007 Primo Distributors Pvt. Ltd. (PDPL) (ii) India - 100 - -8 Palmer Investment <strong>Group</strong> Ltd.(PIG) British VirginIslands100 100 - -9 RG Shaw & Company Ltd. (RGSC) U.K. 100 100 - -10 Shaw Scott & Company Ltd. (SSC) U.K. 100 100 - -11 Shaw Darby & Company Ltd. (SDC) U.K. 100 100 - -12 Thames Rice Milling Company Limited (TRMC) U.K. 100 100 - -91