president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

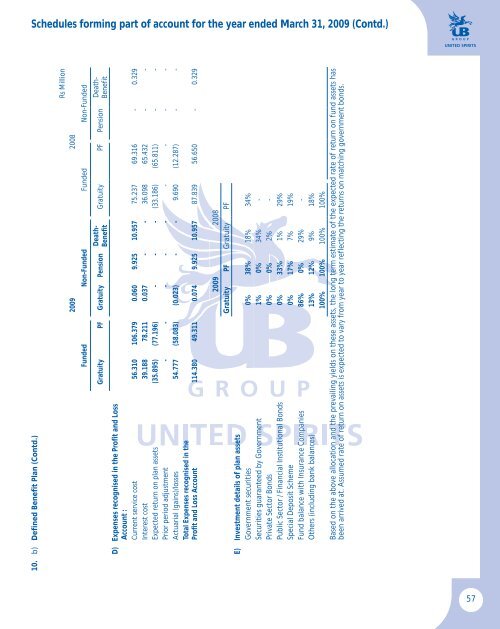

Schedules forming part of account for the year ended March 31, 2009 (Contd.)10. b) Defined Benefit Plan (Contd.)2009 2008Funded Non-Funded Funded Non-FundedGratuity PF Gratuity Pension Death-BenefitGratuity PF PensionRs MillionD) Expenses recognised in the Profit and LossAccount :Current service cost 56.310 106.379 0.060 9.925 10.957 75.237 69.316 - 0.329Interest cost 39.188 78.211 0.037 - - 36.098 65.432 - -Expected return on plan assets (35.895) (77.196) - - - (33.186) (65.811) - -Prior period adjustment - - - - - - - - -Actuarial (gains)/losses 54.777 (58.083) (0.023) - - 9.690 (12.287) - -Total Expenses recognised in theProfit and Loss Account 114.380 49.311 0.074 9.925 10.957 87.839 56.650 - 0.329Death-Benefit2009 2008Gratuity PF Gratuity PFE) Investment details of plan assetsGovernment securities 0% 38% 18% 34%Securities guaranteed by Government 1% 0% 34% -Private Sector Bonds 0% 0% 2% -Public Sector / Financial Institutional Bonds 0% 33% 1% 29%Special Deposit Scheme 0% 17% 7% 19%Fund balance with Insurance Companies 86% 0% 29% -Others (including bank balances) 13% 12% 9% 18%100% 100% 100% 100%Based on the above allocation and the prevailing yields on these assets, the long term estimate of the expected rate of return on fund assets hasbeen arrived at. Assumed rate of return on assets is expected to vary from year to year reflecting the returns on matching government bonds.57