president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

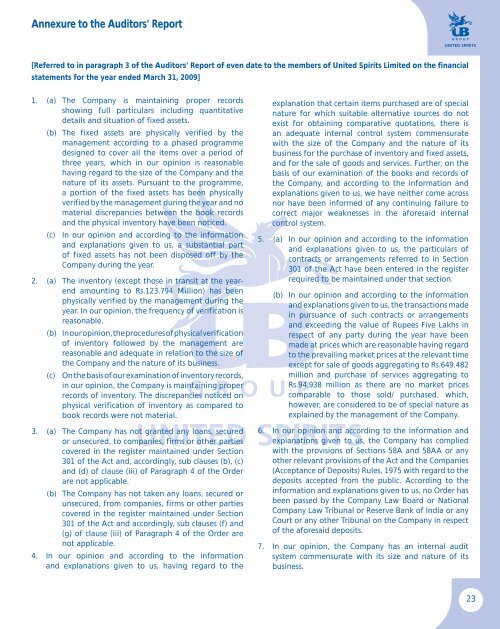

Annexure to the Auditors' Report[Referred to in paragraph 3 of the Auditors’ Report of even date to the members of United Spirits Limited on the financialstatements for the year ended March 31, 2009]1. (a) The Company is maintaining proper recordsshowing full particulars including quantitativedetails and situation of fixed assets.(b) The fixed assets are physically verified by themanagement according to a phased programmedesigned to cover all the items over a period ofthree years, which in our opinion is reasonablehaving regard to the size of the Company and thenature of its assets. Pursuant to the programme,a portion of the fixed assets has been physicallyverified by the management during the year and nomaterial discrepancies between the book recordsand the physical inventory have been noticed.(c) In our opinion and according to the informationand explanations given to us, a substantial partof fixed assets has not been disposed off by theCompany during the year.2. (a) The inventory (except those in transit at the yearendamounting to Rs.123.794 Million) has beenphysically verified by the management during theyear. In our opinion, the frequency of verification isreasonable.(b) In our opinion, the procedures of physical verificationof inventory followed by the management arereasonable and adequate in relation to the size ofthe Company and the nature of its business.(c) On the basis of our examination of inventory records,in our opinion, the Company is maintaining properrecords of inventory. The discrepancies noticed onphysical verification of inventory as compared tobook records were not material.3. (a) The Company has not granted any loans, securedor unsecured, to companies, firms or other partiescovered in the register maintained under Section301 of the Act and, accordingly, sub clauses (b), (c)and (d) of clause (iii) of Paragraph 4 of the Orderare not applicable.(b) The Company has not taken any loans, secured orunsecured, from companies, firms or other partiescovered in the register maintained under Section301 of the Act and accordingly, sub clauses (f) and(g) of clause (iii) of Paragraph 4 of the Order arenot applicable.4. In our opinion and according to the informationand explanations given to us, having regard to theexplanation that certain items purchased are of specialnature for which suitable alternative sources do notexist for obtaining comparative quotations, there isan adequate internal control system commensuratewith the size of the Company and the nature of itsbusiness for the purchase of inventory and fixed assets,and for the sale of goods and services. Further, on thebasis of our examination of the books and records ofthe Company, and according to the information andexplanations given to us, we have neither come acrossnor have been informed of any continuing failure tocorrect major weaknesses in the aforesaid internalcontrol system.5. (a) In our opinion and according to the informationand explanations given to us, the particulars ofcontracts or arrangements referred to in Section301 of the Act have been entered in the registerrequired to be maintained under that section.(b) In our opinion and according to the informationand explanations given to us, the transactions madein pursuance of such contracts or arrangementsand exceeding the value of Rupees Five Lakhs inrespect of any party during the year have beenmade at prices which are reasonable having regardto the prevailing market prices at the relevant timeexcept for sale of goods aggregating to Rs.649.482million and purchase of services aggregating toRs.94.938 million as there are no market pricescomparable to those sold/ purchased, which,however, are considered to be of special nature asexplained by the management of the Company.6. In our opinion and according to the information andexplanations given to us, the Company has compliedwith the provisions of Sections 58A and 58AA or anyother relevant provisions of the Act and the Companies(Acceptance of Deposits) Rules, 1975 with regard to thedeposits accepted from the public. According to theinformation and explanations given to us, no Order hasbeen passed by the Company Law Board or NationalCompany Law Tribunal or Reserve Bank of India or anyCourt or any other Tribunal on the Company in respectof the aforesaid deposits.7. In our opinion, the Company has an internal auditsystem commensurate with its size and nature of itsbusiness.23