president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

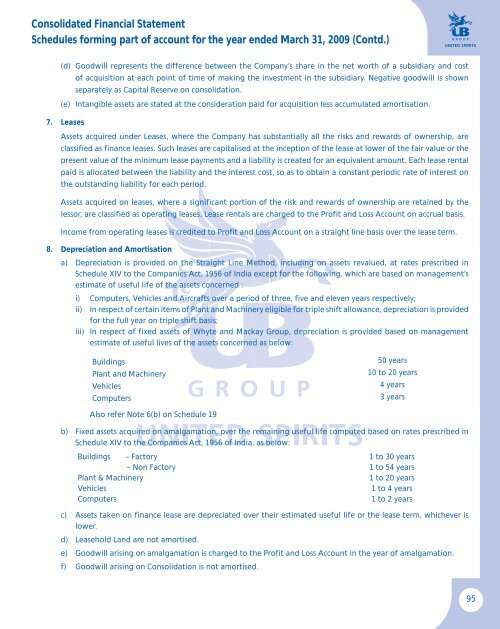

Consolidated Financial StatementSchedules forming part of account for the year ended March 31, 2009 (Contd.)(d) Goodwill represents the difference between the Company’s share in the net worth of a subsidiary and costof acquisition at each point of time of making the investment in the subsidiary. Negative goodwill is shownseparately as Capital Reserve on consolidation.(e) Intangible assets are stated at the consideration paid for acquisition less accumulated amortisation.7. LeasesAssets acquired under Leases, where the Company has substantially all the risks and rewards of ownership, areclassified as finance leases. Such leases are capitalised at the inception of the lease at lower of the fair value or thepresent value of the minimum lease payments and a liability is created for an equivalent amount. Each lease rentalpaid is allocated between the liability and the interest cost, so as to obtain a constant periodic rate of interest onthe outstanding liability for each period.Assets acquired on leases, where a significant portion of the risk and rewards of ownership are retained by thelessor, are classified as operating leases. Lease rentals are charged to the Profit and Loss Account on accrual basis.Income from operating leases is credited to Profit and Loss Account on a straight line basis over the lease term.8. Depreciation and Amortisationa) Depreciation is provided on the Straight Line Method, including on assets revalued, at rates prescribed inSchedule XIV to the Companies Act, 1956 of India except for the following, which are based on management’sestimate of useful life of the assets concerned :i) Computers, Vehicles and Aircrafts over a period of three, five and eleven years respectively;ii) In respect of certain items of Plant and Machinery eligible for triple shift allowance, depreciation is providedfor the full year on triple shift basis;iii) In respect of fixed assets of Whyte and Mackay <strong>Group</strong>, depreciation is provided based on managementestimate of useful lives of the assets concerned as below:BuildingsPlant and MachineryVehiclesComputers50 years10 to 20 years4 years3 yearsAlso refer Note 6(b) on Schedule 19b) Fixed assets acquired on amalgamation, over the remaining useful life computed based on rates prescribed inSchedule XIV to the Companies Act, 1956 of India, as below:Buildings – Factory 1 to 30 years– Non Factory 1 to 54 yearsPlant & Machinery1 to 20 yearsVehicles1 to 4 yearsComputers1 to 2 yearsc) Assets taken on finance lease are depreciated over their estimated useful life or the lease term, whichever islower.d) Leasehold Land are not amortised.e) Goodwill arising on amalgamation is charged to the Profit and Loss Account in the year of amalgamation.f) Goodwill arising on Consolidation is not amortised.95